The Infinite Banking Concept is an investment strategy that utilizes the benefits of life insurance to grow wealth and save for retirement. It’s a unique strategy that can work as a replacement for traditional investment options, but it is often misunderstood.

Traditional retirement approaches–401ks and IRAs–keep money locked up, at risk, and may create future tax problems. The Infinite Banking Concept solves these problems by giving individuals a way to store money where it can grow safely, avoid future taxation, and be available for business or investment opportunities.

In this article, we explore Infinite Banking, what it is, how it works, and why we use life insurance. We will also go through some examples of the Infinite Banking Concept and discuss common misconceptions.

By the end, you will better understand the Infinite Banking strategy and whether it suits you and your investment goals.

What is the Purpose of Infinite Banking?

We all want to build wealth, retire, and pass something down to our family when we die. Achieving this goal is the core purpose of any financial strategy, including the Infinite Banking Concept.

But not every financial strategy is created equally. Those that practice Infinite Banking believe there are some real negative consequences from the financial and retirement model used by most Americans today.

Let’s look at the difference in the Infinite Banking Concept’s approach compared to traditional investments like a 401k or IRA.

Keep Money Liquid

Retirement accounts require you to lock money away for decades before they are accessible. This limits your ability to make decisions for yourself. Whether you want to invest in real estate, start your own business, or take advantage of other unique opportunities, these options are unavailable when money is locked away.

The philosophy behind the Infinite Banking Concept is to keep money liquid and accessible so you can take advantage of opportunities to grow your wealth when they become available. Freedom, personal responsibility, and personal growth all come from having money accessible and looking for opportunities to grow your wealth and yourself.

Lower Taxes

Many Americans have been convinced that deferring taxes is a good idea. But this is not always so simple, and traditional retirement accounts may leave investors paying more in taxes than they expect.

For example, the majority of workers make more money as they get older, not less. And in this case, they would be better off paying taxes at the lower tax rate when they initially earned the money, not deferring that tax burden into the future.

Also, tax rates are variable. Deferring taxes today is a bet that tax rates will be the same, or lower, in the future. But will they? With government debt the way it is today, there is more risk that taxes increase in the future, not decrease.

Taxes are the biggest lifetime cost to most every American. Infinite Banking is about reducing overall taxes. It’s smart to look for ways to reduce taxes today, but not if it means increasing taxes in the future.

The Infinite Banking Concept is about investing in ways that lower taxes, or even reduce taxes to zero. This reduces overall lifetime taxes paid and takes the risk out of paying taxes in the future.

Reduce Risk

Time and time again investors find out the hard way that all their retirement assets are in one bucket–the market. And when a “black swan” event happens, like it does every 10 years or so, traditional retirement plans take drastic losses.

And if you were planning to retire when one of these events takes place, you could be in major trouble.

Infinite Banking is about finding a safer environment, where you won’t lose hard earned capital due to market conditions.

Then, if and when the market does drop, you can take advantage of investment opportunities at lower prices, and with preserved capital.

Minimize Government Control

401ks and IRAs are government sponsored programs and, ultimately, under their control. What happens if the government decides to change regulations, or just decides it needs the money from these retirement accounts to fund their own spending?

Just because it hasn’t happened doesn’t mean that it won’t.

Infinite Banking keeps money out of these government controlled programs and helps create a layer of government protection around your assets.

These are the primary philosophical differences that set Infinite Banking apart from traditional financial planning.

And this is where life insurance comes in. Life insurance is a non-traditional investment tool that, when structured properly, offers a solution that works in tandem with Infinite Banking’s philosophies. Once you understand life insurance and what it offers, you’ll see why it’s the obvious best choice to use as an alternative to government sponsored programs.

Let’s look deeper into life insurance as an investment.

Why Use Life Insurance?

Life insurance is a misunderstood product. We all understand the basic idea of using life insurance to safeguard loved ones from the cost of death.

However, certain types of insurance, like whole life and universal life, actually offer something better than life insurance–they provide a valuable alternative for wealth management and retirement planning.

These types of life insurance policies are also called cash value life insurance, because they come with an attached cash value component in addition to the insurance component.

This cash value account is what makes life insurance work for the Infinite Banking Concept. Cash value life insurance has benefits not found anywhere else.

But where do these benefits come from?

Let’s examine cash value life insurance and its benefits, by taking a brief look at the history of modern life insurance and how it got where it is today.

How Life Insurance Companies Formed

Centuries ago, as the modern economic landscape developed, there were groups of individuals who realized they had a need for life insurance.

They got together and created a plan. By pooling a portion of their capital together, they could offer a payout to the families of a participating individual when they died.

Over time, they better understood how much to collect from each individual-called the premium–as it related to the payout to the family when the insured died–called the death benefit.

To make sure they collected enough money, they would overcharge the members of the group, and then pay that overcharge back in the form of a dividend.

But this led to a problem. They had a pool of money sitting around doing nothing. And it needed somewhere to go.

They couldn’t afford being risky with capital intended to cover a death benefit, so they looked to safe investment options for this capital.

Eventually, they came up with a long-term, safety focused investment strategy that relied on a diversified portfolio of federal bonds, real estate, corporate notes, and more.

Life insurance organizations became experts at investing money safely and for long periods of time. Because they were investing from the pool of capital contributed by these insured individuals, any returns on that capital–after general business expenses–were distributed to the policyholders in the form of a dividend–tax-free.

Then, in the early 1900s, R. Nelson Nash caught on to the financial benefits of this life insurance structure, and began looking for ways to take advantage of these benefits more effectively.

R. Nelson Nash–The Father of Infinite Banking

R. Nelson Nash was a young man from Georgia who worked in forestry. Because of this, he was used to thinking about life, and wealth, at a big picture level.

Trees take a long time to grow. If your business is planting trees today, and harvesting decades later, you must plan well in advance if you want to succeed.

Nash was also very interested in making money and growing his net worth. He spent much of his downtime reading financial books and analyzing investment strategies.

Through his study, Nash discovered life insurance, and realized the potential power as an investment tool.

Discovering Life Insurance as an Investment

He saw that many wealthy individuals, like Ray Kroc–the owner of McDonalds–and Walt Disney of the Disney Corporation, owned a substantial amount of cash value life insurance which they used like a bank. When they needed capital, they borrowed money from their life insurance cash value, and then paid it back overtime.

As he dug in deeper, he realized that these cash value life insurance policies had many benefits that were unknown to most individuals.

On top of that, he discovered that if these life insurance policies were “overfunded”–or more money was put into them than just the minimum insurance premium–these policies grew faster, and still retained the tax benefits and liquidity that life insurance offered.

Nash also opposed big government and the federal reserve. He saw the banking system as a detriment to individuals, using inflation to rob individuals of their hard earned money.

And so, life insurance became a means of optimizing financial benefits, as well as keeping money out of the banking system and taking stewardship over your own finances by creating a personal bank.

These discoveries are the origin of Infinite Banking Concept and Becoming Your Own Banker. Nash would spend the rest of his life developing and teaching others this concept.

What Are the Benefits of Infinite Banking and Life Insurance?

What are the benefits of life insurance that Nash discovered? In this section we explore the five primary benefits of life insurance and why they work so well as an alternative approach to traditional investment approaches.

Benefit #1 – Life Insurance Reduces Taxes

First off, life insurance offers a way to save money on taxes.

Over your lifetime, taxes will likely be the biggest expense you will ever pay.

And, as mentioned early, 401ks and IRAs don’t solve the tax problem, they merely defer it off into the future. Many individuals will end up paying more in taxes than they would have when they were younger.

As one study showed, “The average American will pay $524,625 in taxes throughout their lifetime–that’s a third (34.7%) of all estimated lifetime earnings ($1,494,986) spent on taxes.”

For most Americans that $500,000 is the difference between being moderately wealthy, and being nearly poor. That’s why saving money on taxes is important for building wealth–the more tax dollars you save, the more you put towards your future.

Life insurance helps by reducing the overall amount of tax you will pay.

The returns from growth inside the life insurance policy payout in the form of a dividend–or a return of premium. These dividends grow tax-free.

Furthermore, as long as the life insurance policy is in-force–meaning it hasn’t been canceled or overdrawn–when the insured dies, the policy transfers income tax-free.

Consequently, the growth inside of a life insurance policy will transfer with no taxation (for those under estate tax limits) when you die.

Life insurance grows tax-free, and transfers to beneficiaries tax-free, allowing you to completely avoid taxes through your life and when you die.

And on top of life insurance, you can also use other tax strategies to help reduce taxes, and put more of that money to work for you.

Benefit #2 – Life Insurance is Liquid and Accessible

Traditional investments like 401ks and IRAs lock money away until the individual is at a certain retirement age and needs the money.

As discussed before, these retirement accounts come with many risks, but one of the biggest is lack of liquidity.

A big focus of the Infinite Banking Concept is on personal responsibility and personal growth. Typically, an individual who locks money away into a traditional retirement account isn’t thinking about the future–they have likely have a stable job and are focused on that.

However, as people get older, they begin thinking about making their own investments, or starting their own business. And it’s not until they get to this point in their lives that they realize they have little to no access to the capital they need–it’s locked away.

And as these opportunities come their way, they lose out on potentially big investment or business opportunities because they don’t have the liquid access to capital they need.

Life Insurance, Liquidity, And Policy Loans

Cash value life insurance is different from traditional retirement accounts. Inside of a life insurance policy, your cash value can be borrowed from the policy at any time with no questions asked.

This means, if you have $50,000 in policy cash value, you can simply fill out a form with the requested amount, and you get the money from the life insurance company.

And because the cash value is already in your account, there is no credit check or qualification process. It’s simply a loan based on cash value that is already in the account.

But why borrow? Why not just liquidate the money out of the policy? Isn’t this just complicating the process?

It’s a good question, let’s look into it.

Life Insurance Policy Loans

Liquidity in a life insurance policy comes in two forms–policy loans or liquidation.

There is a good reason that policy loans are more effective than liquidating the account.

Getting money into a life insurance policy is not as easy as just depositing it into the account, like a bank. Because of the tax benefits life insurance offers, there are rules and regulations as to how cash is put into the policy.

It takes time to build cash in an insurance policy.

Once you go through the trouble of getting cash into the policy, you don’t want to take it back out. It’s just not worth the time and effort to put it back in. So, instead, by borrowing against the cash value of the policy, you get access to your capital without liquidating policy funds.

Life insurance companies offer simple loans to anyone against their cash value. The reason? Because cash value is a cash asset, and there is no risk to the life insurance company giving you a collateralized loan against cash.

More About Policy Loans

When you borrow against the cash value, you pay an interest rate back to the life insurance company. However, because this is a loan, the money in your account hasn’t left.

And you are still receiving a dividend on the cash value in your policy. So the loan you receive, and the dividend you make on the policy, are often a wash.

But the dividend you received may differ based on the life insurance company you use.

When it comes to having a loan outstanding and the dividend you receive there are two types of life insurance companies–direct recognition and non-direct recognition.

Non-direct recognition companies ignore policy loans when calculating dividends, and provide a pay out based on the total value of your policy.

Direct recognition companies do take policy loans into account when paying out dividends–which may have an impact on the dividends you receive.

This difference is often minimal, but it is important to understand. You can learn more about direct vs. non-direct recognition companies here.

However, you have another, often better, option for acquiring these loans–borrowing money from a bank.

Cash Value Line of Credit

A standard life insurance-based loan most banks offer is called a CVLC, or cash value line of credit.

Acquiring one of these loans is a simple process. Your cash value in the policy is considered cash, so banks are willing to loan against it with very little application process.

But the loan you receive isn’t the same as borrowing from the life insurance company. Where life insurance companies loan based on the expected annual dividend, banks loan based on the LIBOR index–which is the industry standard interest rate index.

Historically, the interest paid on this CVLC loan has been lower than the dividend earnings in a life insurance policy. That means, taking this loan actually nets you a spread–or the difference between what you pay on the loan and what you earn in your policy.

At Wise Money Tools, you can use the spread on these loans to your advantage. This is the core of our leveraged life insurance strategy, where we use this spread to leverage a higher rate of return with low-risk.

You can learn more about our leveraged life insurance strategy here.

Liquidity is one of the most important benefits of life insurance. And no matter which option you decide to use, you’ll have access to capital when you need it, no matter the reason.

Now, let’s move to the next benefit of life insurance, growth potential.

Benefit #3 – Life Insurance Has Significant Growth Potential

Growing your money is important. Building long-term wealth is often done by getting a strong return on your money over a long period of time.

Government sponsored programs are typically used because they offer long-term growth potential.

But what about life insurance?

Cash value life insurance offers growth in a few different ways. The first is growth inside the policy–which will depend on the type of cash value life insurance you are using–and second is outside of the policy–using cash value to take advantage of external investment or business opportunities.

Let’s first look at the two different types of cash value life insurance policies available. Then we will discuss growing money through external investment opportunities.

Two Different Life Insurance Policy Options

There are two types of cash value life insurance policies that you can use for the Infinite Banking Concept. Each of these has different growth rates and potential.

Typically, it’s best to use a blend of each of these types of insurance, depending on your age and risk tolerance. But it’s ultimately up to you what level of risk/reward you want.

The two types of cash value life insurance are whole life insurance and universal life insurance. They have similarities, but offer distinct differences in how they earn interest and grow.

Whole Life Insurance

Of the two, whole life insurance is the safest and is more predictable.

Because life insurance companies invest so heavily into bonds, they often average around the same rate as long-term bonds.

Whole life insurance growth is much less volatile. Dividend rates often adjust slowly, moving in small increments up or down over long stretches of time.

Historically, the growth has been quite strong.

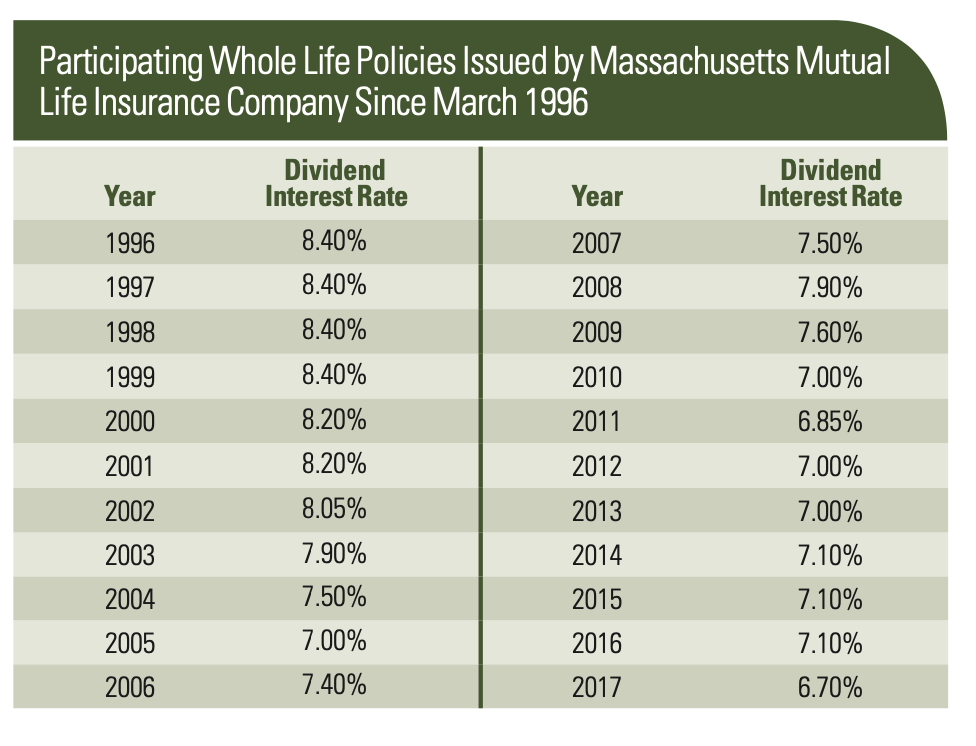

This study showed that from 1996-2017 one major life insurance company averaged 7.58% growth.

When combined with the tax advantages, this would be the equivalent of 10.8% before taxes at a tax rate of 30%.

This level of growth is competitive. However, universal life offers a different approach to growth that offers more potential.

Indexed Universal Life Insurance

Indexed universal life insurance, or IUL for short, is our second type of cash value life insurance. An IUL works differently than whole life because an IUL relies on the index to generate returns.

Where whole life would be investing in government bonds or real estate, an IUL invests a small portion of its cash value to purchase an option on an index–typically the S&P 500.

Options are a unique strategy. An option allows you to pay a small amount today to bet on the future price of a stock or index. If that stock or index goes up, you make money.

But if the stock stays flat, or goes down, you can’t lose more than the cost of the option. Your losses are capped. All you lose is the initial, smaller amount that you spent to buy the option.

Using the Index

Indexed universal life uses this strategy to grow money. When the index has a good year, then you can make more money than you would in a whole life insurance policy–up to a certain capped amount.

Historically, this strategy has proven itself to be very effective. However, it is riskier than whole life insurance because there are costs that must be paid by your cash value in the event your options do not produce a return.

That’s why we often recommend some universal life insurance and some whole life insurance. With a mix of these two different types of cash value life insurance, you capitalize on good market years, but you mitigate the risk of losing money in bad years.

This gives you a good sense of how cash value grows inside of a life insurance policy. However, Infinite Banking isn’t simply about investing in life insurance. Real growth using the Infinite Banking Concept will come from investment opportunities found outside of your life insurance policy.

Growing Wealth Through Investment Opportunities

Where is true wealth made? It’s a mystery to most people, but the answer, even though difficult to execute, is very simple.

Invest in cash flowing assets–ideally when they are cheap.

One of the core principles of the Infinite Banking Concept is learning to create wealth for yourself. Rarely does anyone become a millionaire through their 401k.

If you really want to create wealth, you must prepare and take advantage of investment or business opportunities.

Real, double digit growth comes from these opportunities. Building a business, investing in real estate, or even putting money in the market after a big downturn. These are all ways investors create life changing wealth.

In order to accomplish this you need liquidity and access to capital and you need a place where your money can grow when you aren’t using it.

But there is another important characteristic when it comes to taking advantage of these opportunities. And that’s safety.

Benefit #4 – Life Insurance is Safe

When it comes to smart investing, having a place to store money where it is safe is important.

Government sponsored accounts like 401ks and IRAs are volatile and tied to market movements.

Market crashes are often the most obvious and most profitable time to create significant wealth.

But if your money is already in the market then these events won’t be the opportunities, but significant loss events you will need to ride out.

And losses are extremely detrimental. The negative impact from losses far outweighs the positive impact of gains.

Example of Losses vs. Gains

Let’s explain by looking at two examples, each in a different order, starting with $100,000 in capital.

Example #1:

- $100,000

- Year 1: 50% Gain = $50,000 → $150,000

- Year 2: 50% Loss = ($75,000) → $75,000

Example #2:

- $100,000

- Year 1: 50% Loss = ($50,000) → $50,000

- Year 2: 50% Gain = $25,000 → $75,000

In our first example we had a 50% gain in year one, followed by a 50% loss.

The second example shows the same thing but in reverse, a 50% loss year followed by a 50% gain.

In each example the outcome is the same. The losses far outweigh the gains.

That’s why Warren Buffet says “The first rule of an investment is don’t lose money. And the second rule of an investment is don’t forget the first rule.” Losses have an outsized impact on wealth.

With Infinite Banking the goal is different. You want to avoid losses at all costs. That’s where life insurance comes in.

Guaranteed, No-Loss Provisions

Cash value life insurance is not a risk asset. Whether in a whole life policy or an IUL, there are no losses from market fluctuations.

More specifically with whole life insurance, there is a no-loss provision, or a guaranteed minimum growth rate in the policy.

This minimum growth rate is typically 1-2% annually, but varies depending on the type of policy and the company providing the policy.

And although the minimum guarantee is important, the likelihood of earning only the guaranteed minimum in whole life insurance is low. The guaranteed minimum is only paid out if for some reason no dividend is paid for the year. If a dividend is paid, that means you are earning more than the guaranteed minimum.

High quality whole life insurance companies have paid a dividend every year for over 100 years. It is unlikely that you will ever earn as low as this minimum guaranteed interest rate.

Life insurance is meant to be a safer alternative to government sponsored programs. Because of these minimum guarantees, life insurance is protected from market volatility.

Bankruptcy & Creditor Protection

In many states, cash value life insurance is exempt from bankruptcy and offers protection from creditors. This means, if you go bankrupt or owe a debt, your life insurance cash value may be protected from creditors and the government.

Laws vary from state to state, but it’s important to understand that this is another layer of protection and safety that life insurance offers.

Life insurance offers safety benefits not found in traditional investment options. And, if the government ever decides to add taxes or distribute funds from these retirement accounts differently, these accounts could potentially be even more risky than other traditional investments.

These features combine to make life insurance a much safer alternative to traditional investments.

Benefit #5 – Life Insurance Provides Insurance

Lastly, life insurance offers insurance coverage.

Although often an afterthought of the Infinite Banking Concept strategy, the life insurance component provides death benefit which can be substantial.

The death benefit not only transfers income-tax free, it saves you money by eliminating the need for term insurance and other life insurance needs.

Having enough life insurance to cover you in the event of death happens unintentionally when using the Infinite Banking Concept. It’s not the primary purpose, but it’s good to understand the added benefit of using the strategy.

These are the primary benefits of life insurance. And when you put all these benefits of reduced taxes, liquidity, growth, safety, and insurance together, you get a reasonably strong alternative to traditional investments.

Now that you have a thorough understanding of how life insurance works for the Infinite Banking Concept, let’s address one of the most common misconceptions about Infinite Banking.

Is Infinite Banking a Scam?

Today, it’s easy to generate interest by making bold claims and big accusations. But often, these claims are not backed up by facts. Let’s address a common question, “Is Infinite Banking a scam?”

The simple answer is this: No. Infinite Banking is not a scam. However, there are many people out there that call Infinite Banking a scam.

Let’s look at some of the reasons why this is:

- Traditional Financial “Experts”: There are many individuals who think the current system works. They love Wall-Street methods, and maybe even benefit when others invest in the current system of IRAs and 401ks. These people dislike anything non-traditional. Infinite Banking may not fit their investment style, but that doesn’t make it a scam. Is Infinite Banking better than Wall-Street and government sponsored methods? We think so! But that doesn’t mean that it works for everyone.

- Infinite Banking Agents: There are many Infinite Banking agents out there. These agents sometimes misunderstand, use hyperbole, or outright lie about Infinite Banking and its benefits. They paint a picture that somehow there is something free to be gained by using this concept. There isn’t. When Infinite Banking is sold this way, it sounds too good to be true. And any smart individual knows, something that sounds too good to be true usually is. Beware of anyone making Infinite Banking sound as if you are getting a free lunch. There is no free lunch.

- Life Insurance is Complicated: Understanding life insurance and Infinite Banking can be a bit difficult. For this reason, many call Infinite Banking a scam and distort its potential. Flashy titles like “Infinite Banking Scam” go a long way to get clicks and views, but don’t do much to help people understand the concept.

Alternative Investment

These are the primary reasons Infinite Banking is labeled a scam. However, Infinite Banking is nothing more than an alternative to traditional investing that stores cash using life insurance instead of locking money away in IRAs and 401ks. It has its pros and cons.

It doesn’t work for everyone, and no financial approach does. But it is not a scam. It’s a great way to build wealth, invest money, and build a strong retirement portfolio for your future.

The Pros and Cons of Infinite Banking

Now, let’s take a look at some of the pros and cons of the Infinite Banking Concept. This is meant to show some of the advantages, and some of the disadvantages, or using this concept as an alternative to traditional retirement plans.

Pro: Getting Money Out of Wall-Street

The first pro of Infinite Banking is getting money out of Wall Street and high-risk investments.

Traditional retirement plans are subject to market volatility. If significant market losses hit when you are about to retire, it could take decades to recover, delaying your retirement plans and throwing your future off track.

Moreover, most investors do not benefit much from traditional market strategies. Let’s look at a few key facts about investing in Wall-Street and government sponsored retirement accounts.

- Individual investors underperform the market: One study showed that over the last 20 years, individual investors earned an average of 4.25% per year compared to the S&P 500’s 6.06%.

- 401ks have high fees and hidden fees: As this documentary on 401ks uncovered, many fees in 401ks plans are purposely hidden or unclear. These fees add up to a substantial amount of lost opportunity over your lifetime.

- Mutual funds do not perform well: Not one mutual fund has consistently beaten the market over the last five years. This makes it difficult to make the right decisions when managing your money, or when others manage your money for you.

Most of those involved with the Infinite Banking Concept wish to get their money outside of Wall Street. If you experienced market losses in your past and want a safer strategy for your future, Infinite Banking is a strong alternative.

Con: Infinite Banking Takes Time to Build Value

On the downside, Infinite Banking takes time.

When you put money into a bank account, bond, or almost any other investment, that money is immediately available. But, life insurance doesn’t work this way.

Because Infinite Banking uses life insurance as a “bank,” your investing timeline is subject to life insurance restrictions.

Regulations around life insurance say there can only be a certain percentage of capital, or cash value, in relation to the total life insurance coverage during the first years of the policy.

In short, cash value takes longer to build.

Here is the typical breakdown of capital liquidity during the first years of a life insurance policy:

- Year 1: 50-65% of premiums available.

- Year 5: 85-95% of premiums available.

- Year 10: 105-110% of premiums available.

- Year 15: 120-130% of premiums available.

- Year 15+: Continuous dividend growth.

The time it takes for your cash value to build does not affect overall growth. However, it does restrict the amount of cash available to borrow against when starting a new life insurance policy.

Infinite Banking policies take time to build, making the strategy unique when compared to other investments.

Pro: Potential Growth Rate & Safety

The next pro of Infinite Banking is the competitive potential growth rate compared to other savings-type investment vehicles. Also, the minimum guaranteed returns that come with life insurance.

As mentioned before, one study showed whole life insurance policies growing at 7.58% from 1996-2017.

Compared to bonds, CDs, money market, or bank savings accounts, life insurance often performs better. Additionally, life insurance offers many other benefits, like liquidity and tax advantages, that these options do not offer.

On top of this, life insurance has minimum guaranteed annual returns. This makes it safer than many other investment options.

Con: Cost of Life Insurance

The next downside is the cost of insurance.

Because of the tax advantages, life insurance has rules. These rules state that an individual must have a certain percentage of their premium paid towards life insurance in the first years of the policy.

The cost of insurance is why Infinite Banking Concept policies take longer to accumulate cash value. And if you cancel the policy in the first couple of years, you won’t get that capital back.

Insurance costs also vary based on the individual, age, health, and other factors that make an Infinite Banking policy perform better or worse.

The insurance cost is a potential barrier to entry for those considering Infinite Banking. One could argue that the cost does buy something–insurance. However, it is still a cost that you must take into account.

Pro: Liquidity and Access to Capital

The next benefit is liquidity and access to capital.

With 401ks, IRAs, bonds, CDs, stocks, and mutual funds, you must sell the asset to access the capital.

That means you will take a hit to your capital if you need the money, but the asset is in flux. If you are down, you must sell at a loss. On top of this, you may trigger taxable events when you sell, costing you even more.

Either way, simply accessing your own money becomes a losing situation.

Life insurance offers liquidity and easy access to capital not found in most investment options. This is done by taking a loan from the life insurance company against the cash value in the policy.

It’s a quick and easy process that gives the individual access to the money they need for whatever they want, whenever they want.

Whether a smart investment opportunity arises or there are personal needs for accessing the money, life insurance offers liquidity and access to capital not found in traditional investments.

Con: Lack of Flexibility

Another downside of Infinite Banking is the lack of flexibility, especially when growing the policy.

An Infinite Banking policy is set up in reverse to a standard life insurance policy.

Typically, when buying insurance, you start with the amount of insurance you want and then calculate the premium, or payment, necessary to buy that amount of insurance.

Infinite Banking is the opposite. Instead, it asks, “How much premium do I want to pay,” and then determines the least amount of life insurance possible. Reversing the thinking maximizes the cash value of the policy.

But because a policy is optimized for a specific premium payment, it will only be effective if that premium payment target is hit.

For instance, if you set up a policy based on a $100,000 premium per year, but for some reason only afford to put in $50,000 next year, this makes the policy less efficient.

While there are ways to address these issues, and overtime the policy growth rate will likely still be reasonable, this lack of simple flexibility makes Infinite Banking require more planning and makes it less convenient compared to other savings vehicles.

Pro: Tax-Advantaged

Taxes are often the biggest expense you will pay over your lifetime. The more you can reduce your overall taxes, the more money you put into your pocket for your life, your future, and your family.

There are three unique tax advantages of Infinite Banking:

- Dividend Payments

- Loan Repayments

- Death Benefit

Let’s look at each of these briefly.

First, dividends are how the life insurance policy grows. They are considered a “return of premium” which makes dividend payments tax-free.

And by keeping these dividends in the policy and allowing them to compound, you can avoid taxes indefinitely.

Next, there are also tax savings for loan repayments.

Interest paid on a loan used for business or investment purposes is tax deductible.

If used for investment purposes, you can write off the interest paid on your life insurance policy loan.

Lastly, when you die, life insurance transfers to beneficiaries income tax-free.

As long as the policy is in-force, or hasn’t been canceled, your beneficiaries won’t pay taxes.

The only taxation an individual would pay on this death benefit is estate tax–which is in the millions of dollars and depends on the state you live in.

These tax advantages make life insurance one of the best investments when it comes to saving money on taxes.

Con: Requires an Expert

The last negative of the Infinite Banking Concept is that it requires an expert to set up.

Unlike a bank account or bond, you need help correctly setting up an Infinite Banking Concept policy.

First, the policy must be structured correctly to be effective. On top of this, because this is an insurance product, only a licensed insurance agent can create a policy for you.

For this reason, you will need an experienced agent to help you set up the policy correctly and get it in place.

Get a quote for an Infinite Banking policy from an expert by clicking the link here.

A good agent will be beneficial and make the process easy.

Your policy may not be as effective if created by an inexperienced agent.

This means that the Infinite Banking agent you use makes a difference. You’ll need an expert to get the job done right.

Now that you understand the pros and the cons of Infinite Banking. Let’s look at the process and how to set up an Infinite Banking policy.

How to Setup an Infinite Banking Policy

There is so much information available on Infinite Banking, but it’s difficult to find a real guide to getting started.

Let’s look at the step-by-step process for starting your own life insurance policy for Infinite Banking.

Step 1: Find an Agent

Finding the right agent is an important first step. Your agent is similar to a financial planner, and ultimately determines the outcome of your Infinite Banking policy.

Consider a few things when looking for an agent:

- History–Find someone with a long history of setting up policies. Infinite Banking takes time to build and grow. Five to ten years down the road, when your cash value is established, your agent should still be available.

- Experience–Setting up an Infinite Banking policy takes technical expertise. Doing it wrong creates consequences that may affect you for years. Don’t leave this task to someone without the proper experience.

- Knowledge–You wouldn’t want to take financial advice from someone who isn’t financially successful. Infinite Banking isn’t about insurance, it’s about financial planning. Take the time to find someone who understands finances and provides you with helpful education and direction.

- Uses the Concept–On top of all this, seek an expert with multiple years using life insurance policies themselves for Infinite Banking. You don’t want someone who simply sells the policies, you want someone with a history of using the Infinite Banking Concept in their own lives.

Keeping these points in mind will help you in your search for the right expert to set up your Infinite Banking policies.

You can set up a complimentary one-on-one Infinite Banking strategy session with our expert team right here.

Step 2: Choose a Premium

Next, you’ll choose the amount of premium, or payment, you want invested into the policy.

With Infinite Banking, the policy is reverse-engineered for maximum efficiency. In other words, you choose the amount you put into the policy on a consistent basis. Then your designed policy maximizes the benefits of your selected premium payment.

Also, if you have a lump sum to put in immediately, you can discuss adding that to the policy up-front as well.

Consider these questions about your premium:

- Do I want premium payments made monthly, quarterly, semi-annually, or annually?

- How much can I easily afford to put into the policy for the next 5-10 years without overstretching?

- Do I have a lump sum to put in immediately to kick-start the policy? If so, how much of that do I want to put in right away?

With these questions in mind, you can determine the amount and best method for building your Infinite Banking policy.

Step 3: Review the Policy Quote

Once you decide on a premium, and your agent has the information, they will create a policy illustration, or quote, for you.

Take the time to review the illustration and the information it contains.

While reviewing, take note of these key items:

- Guaranteed Values–These contractually guaranteed values lock in. Use the policy quote for an idea of these values and how they apply to you.

- Cash Value Growth–Understand how the policy grows over time.

- Death Benefit–Your death benefit is the amount of life insurance that you will receive from the policy. It will grow with the cash value as well.

- Break-Even Timeline–This is the time required for the policy to break even. It is not a guaranteed value.

Remember that the insurance company bases non-guaranteed values on today’s current dividend extended indefinitely into the future. This is not how the policy will perform, but a look at how the policy would perform in today’s environment.

Review the policy with your agent and make sure you understand everything involved in your Infinite Banking policy.

Some other questions for your agent.

- What riders or extras are attached to this policy and why?

- Are we using the best insurance carrier for my situation?

- When and how can I access the cash value from my policy?

- Are there any other specifics or special items I should know?

These give you a better idea of the policy, how it will benefit you, and the specifics.

Step 4: Complete the Application

Once you settle on the right Infinite Banking policy and everything looks how you expected, it’s time to complete the application process.

The process involves a series of medical and other questions determining your insurability. If you are not the insured on the policy, then the insured individual will go through this process.

Your agent may complete this questionnaire themselves or utilize an assistant or another authorized individual.

It’s usually an easy process and doesn’t take much of your time.

Step 5: Get Your Medical Exam

The next step of the application is receiving your medical exam. This typically involves an authorized nurse traveling to a convenient destination–like your home or workplace.

The nurse takes a blood draw and performs some other simple tests. They also ask you a series of medical questions. They then send the information and application to the underwriter at the insurance company.

Once this exam is complete, it’s time for the underwriting process.

Step 6: Wait for Underwriting Approval

Now your policy will be reviewed by the insurance company’s underwriting team.

They process the medical exam and application to determine your insurance eligibility by reviewing your medical history.

If any questions arise, they contact you and together with your agent you’ll get it resolved.

The underwriting process takes a few weeks. Once your policy is approved, they will let you and your agent know.

Step 7: Review Your Policy

Now it’s time to review the policy with your agent.

The policy illustration and quote you previously received likely differ from the policy you have now. The new policy is similar, worse, or potentially better, depending on the insurability level determined by the underwriter.

There are a few different insurance rating classifications people fall into depending on health, lifestyle factors, and family history.

- Preferred Plus

- Preferred

- Standard Plus

- Standard

- Tobacco Rating

- Table Rating

Each of these affects the policy presented to you by the agent on behalf of the insurance company.

With your agent, you should review:

- Classification Rating– Check your rating and see how that affects your policy.

- Policy Illustration– Check the numbers and ensure they fit your expectations.

- Premium Amount– Make sure the premium payment is correct and you can commit to it.

Take your time and review this document carefully.

Once everything looks correct, you complete the process of setting up an Infinite Banking policy.

Step 8: Finalize and Fund Your Policy

Once the policy is reviewed, and approved, it’s time to finalize and fund the policy.

This final step involves signing the completed documents and making your first premium payment.

Although this step is serious, it’s not completely set in stone yet. Life insurance policies get a free look period, meaning you have ten or more days to change your mind if the policy isn’t what you expected or for any other reason.

Signing and funding your policy is the last step in setting up a life insurance policy for Infinite Banking.

Now that you understand the full process of establishing an Infinite Banking policy, let’s look at an Infinite Banking example policy and illustration.

Infinite Banking Example Policy

The best way to understand the Infinite Banking Concept, what it does, and how it works is to look at an Infinite Banking example with a whole life insurance policy illustration.

Let’s look at a basic whole life insurance policy set up for the Infinite Banking Concept and review the details.

Above is a classic example of a whole life insurance policy used for Infinite Banking.

Here are the details of this example policy explained:

- Year: Number of policy years; this is broken down into five-year increments to make it more condensed.

- Age: Age of the individual, starting at 34 years old.

- Cumulative Premium Outlay: The amount contributed to the policy in aggregate. This individual contributes $15,000 annually until their late 50s when they taper down. Contributions stop at 65.

- Non-Guaranteed Values: These are projected values based on today’s dividend rate. These values will adjust based on the insurance company and investment conditions.

- Total Net Cash Value: The projected amount of cash accessible for loans.

- IRR on Total Net Cash Value: The projected internal rate of return (IRR) on the cash values by year. The current dividend rate projection is around 4.8% annualized.

- Total Net Death Benefit: The projected death benefit, or the life insurance payout in case of death, by year.

- IRR on Total Net Death Benefit: The projected rate of return on the death benefit if the insurance policy were to pay out.

- Guaranteed Values (Not Pictured): Each policy illustration also has a set of guaranteed values. These are not projections but the minimum guaranteed values contractually obligated to the policy owner.

Analysis

In this example, our 34 year old is planning to invest $15,000 per year until he is in his late 50s. The life insurance policy is projecting around a 4.8% annualized return which fluctuates a bit based on when the individual dies.

Remember, the growth on the non-guaranteed side simply shows today’s growth projected into the future. This will likely change, up or down, depending on factors like interest rates and the economy.

If this individual were to die early, you can see the death benefit return on investment is substantial in the first years, as they are covered by insurance. This then becomes more realistic as that individual ages.

In year one he has $9,698 available in cash value to borrow against. This number continues to go up as the years go by. This means, he has capital immediately available from day one to use for personal or investment opportunities.

Growth Takes Time

It takes time for this policy to maximize growth. However, this policy provided immediate liquidity to the individual who purchased it. What you do with the Infinite Banking policy makes the biggest difference overtime, but the policy itself does show strong, competitive growth potential.

This example should give you a lot more insight into what you can expect from cash value life insurance. The important part is that this policy does exactly what we want it to. It offers growth, access to cash, safety, tax-advantages, and insurance–a place to store and grow money safely while waiting for opportunity.

Now that you understand Infinite Banking, and have seen an example policy, let’s look at a few common misconceptions about Infinite Banking before concluding.

Common Misconceptions

With any investment strategy there are often misconceptions that come up over time. Infinite Banking is no different. Let’s examine these misconceptions and add some clarity to the concept and how it works.

Borrowing Money and Paying Yourself Back Generates Wealth

The first misconception about Infinite Banking is that when you borrow money from your policy, and pay it back, you are somehow generating wealth. The idea is that by paying back your life insurance policy at a higher interest rate, you will accidentally generate wealth.

Those who portray this Infinite Banking misconception will often show you a growth chart at an interest rate of 10% annualized or higher–compounded over 30 years.

They will tell you that if you pay yourself back at 10%, you will grow your money to a much higher level over that 30 year period.

And while this is true, if you pay yourself back at 10% interest rate, compared with earning 5% in your policy, you will grow your money substantially, it’s a slight of hand.

You aren’t actually earning a higher interest rate, you are just paying a higher interest rate to yourself, which is simply the same as saving more money.

And that’s great! But saving more money is not the same as earning a higher interest rate on your money, and it’s deceiving to present it that way.

How You Buy is More Important than What You Buy

There is a common example given in Infinite Banking circles about buying a car and paying back the interest at a higher rate to your life insurance policy. They use the example to make it look as if buying a car through an Infinite Banking policy is an effective way to generate more capital.

It isn’t.

If you want to purchase a car with your policy and pay it back with a higher interest rate, that’s not a bad idea. But if buying a car makes me rich, why not buy a more expensive car? Or why not buy more cars?

It’s a slight of hand. The reality is, you are simply putting more money into your life insurance policy. What you’re going to realize is the amount of money you can put back into your policy will be directly related to the amount of income you can generate. So whether you save that money, or put it into your policy as overpaid interest, the result in your overall wealth is the same.

Ultimately, buying a car is the wrong focus for an Infinite Banking police. In 5 years, that car is going to be worth 25-50% of what it’s worth when you buy it. Cars are depreciating assets that offer no cash flow.

Instead, if you focus on buying cash flowing assets–like real estate, businesses, rental equipment, or other options–over depreciating assets, you’re putting yourself into a position to accumulate wealth.

What you buy is more important than how you buy it.

The true benefit of Infinite Banking is more than growing money while you wait for the opportunity to invest in appreciating assets, it also gives you tax advantages when investing in those assets.

That’s where you will get the most benefit from Infinite Banking.

You Lose Your Cash Value When You Die

Another misconception is that you shouldn’t build cash value because, when you die, the cash value is lost and goes away forever.

It’s a technical truth presented in a misleading way.

The reality is this, cash value is a part of your death benefit. It’s the portion of your death benefit that is available to liquidate–if you decided to cancel the policy–or borrow against.

That means, your death benefit is always going to be higher than the cash value in the policy–because the cash value is simply a portion of the death benefit.

When you die, your beneficiaries get the entire death benefit, minus any loans outstanding. That number already includes the cash value, so it’s not an issue. There is nothing lost here.

Life Insurance is a Bad Investment

Lastly, there is a misconception that life insurance is a bad investment.

There are two arguments being made here.

Low Returns

The first argument is that life insurance is a bad investment because it has low returns.

Let’s look.

According to Nerdwallet, the average stock market return over the last century has been around 10% annualized.

And as previously discussed, from 1996-2017 one prominent life insurance company showed 7.58% growth–which would be a 10.8% before taxes at a tax rate of 30%.

But this misses the point. Life insurance isn’t truly an investment. It more closely resembles a savings vehicle offering tax-advantages and liquidity.

Yes, life insurance offers competitive returns, but life insurance also provides a place to store capital so you can take advantage of investment opportunities.

Life insurance enhances strategies like buying real estate, running a business, or even investing in stocks.

However, for those who want the lower risk and steady growth that life insurance offers, there is benefit in that as well.

The returns on life insurance are competitive, making life insurance a strong alternative to traditional investment approaches.

Term Insurance is Cheaper

The second reason some call life insurance a bad investment is because of the insurance component.

The argument is that term insurance is cheaper, making life insurance a bad option.

But this argument is simply changing the conversation from investing to insurance.

The point of cash value life insurance is to grow money safely while having access to it–not to get insurance coverage.

Whether you invest in bonds, stocks, real estate, or you use cash value life insurance as a place to store capital, you will likely need some kind of insurance coverage.

And term insurance often does a good job at a low price for those needing insurance.

Maximize Your Wealth

Hopefully, at this point, you have a much better understanding of the Infinite Banking Concept.

For the last 25 years, I have used this concept and helped others implement it. It’s a concept that has changed my life, my finances, and the philosophies behind this concept have helped me become a multi-millionaire.

I’ve also seen the tremendous positive impact this concept has had on my clients and helping them generate wealth and success through cash value life insurance.

If you are looking for another way to invest money and get out of what I call the “Wall-Street Rollercoaster,” then you can learn more about the Infinite Banking Concept and other financial topics like reducing taxes, using smart leverage, real estate investing, and more by getting access to our financial tool kit.

This complimentary resource is packed with videos, courses, downloadables, and gives you access to pdf copies of many of the books I have written.

Don’t wait, you can access our tool kit by clicking the link here.