Infinite Banking is an investment strategy focused on growing and compounding capital.

The strategy uses “overfunded,” dividend-paying, whole life insurance policies to maximize results. However, universal life insurance is also a potential option.

In this article, we explore Infinite Banking, what it seeks to accomplish, the use of whole life insurance, and how leveraging this strategy can improve a variety of investment outcomes.

By the end, you should have a better understanding of Infinite Banking and whether it is a strategy that fits you and your investment goals.

Purpose of Infinite Banking

The Infinite Banking Concept originates with R. Nelson Nash. In his 2003 book, “Becoming Your Own Banker: Unlock the Infinite Banking Concept,” he coined terms used today like “Infinite Banking Concept” and “Becoming Your Own Banker.”

In this book, Nash discusses issues with current financial planning and talks about maximizing compounding, keeping money safe, and avoiding the negative impact of taxes.

Many of these themes and core principles have evolved over time to create Infinite Banking as it is today.

What then is the purpose of the Infinite Banking Concept?

The core purpose of all financial strategies, including the Infinite Banking Concept, is to grow wealth.

Infinite Banking does this through two specific steps:

- Create your “personal bank” where uninvested capital can be stored.

- Use your “personal bank” to leverage capital into productive investment opportunities.

Because of the attributes of whole life insurance, Infinite Banking sees this as the most efficient product for creating your “personal bank.”

This leads to the two questions you will need answered before you can fully understand Infinite Banking.

- What are the attributes of whole life insurance that make it so effective?

- How can I use Infinite Banking to make investments and improve outcomes?

Let’s start with a look at whole life insurance.

Whole Life Insurance: Your “Personal Bank”

When most people hear the words “whole life insurance,” they immediately go into defensive mode.

Often, in the media, you will hear whole life insurance described as “awful.”

“Whole life is the worst kind of insurance.”

And I would tend to agree with that sentiment.

If you are looking for strictly insurance coverage, whole life insurance is going to be expensive and impractical when compared to term insurance.

But the purpose here is not insurance–but the best place to store capital for future investments.

There are essentially five benefits that whole life insurance offers you:

- Safety

- Growth

- Liquidity

- Tax Advantages

- Insurance Coverage

I will go through each of these. Let’s start with safety.

Benefit #1: Safety

If you want a place to store your money, then you need that money to be safe. Safety is an important characteristic because when you have an investment opportunity you need your capital to be available.

What kind of safety does whole life insurance have?

Life insurance offers a minimum, guaranteed growth rate of 2-3%.

A guaranteed growth rate means your policy cannot lose money.

When you apply for a whole life insurance policy, the life insurance company shows you the minimum growth rate of the policy.

It’s a guaranteed rate which means it cannot change. The life insurance company is contractually obligated to give you this minimum growth.

This is the kind of safety that Infinite Banking is looking for.

Using whole life insurance as a safe “personal bank” is such a smart strategy that even actual banks utilize it.

Bank Owned Life Insurance (BOLI)

BOLI stands for Bank Owned Life Insurance, and it refers to life insurance policies owned by banks for storing capital.

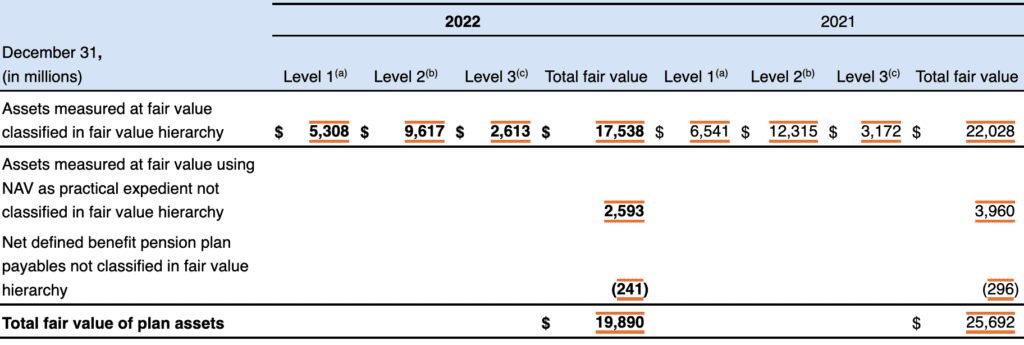

Whole life insurance is considered one of the safest assets. So much so that banks use it to store monetary reserves.

It is classified as a “Tier 1 Asset” and considered one of the safest asset classes.

A quick glance at JP Morgan Chase Bank’s recent annual report shows they have 2.6 billion in cash value life insurance.

This is just a simple example to give you some more information about the safety of whole life insurance.

There are a lot of places where you can get this level of safety but not with all of the other advantages.

So let’s move onto the next benefit–growth.

Benefit #2: Growth

With Infinite Banking, life insurance is simply the storage facility while you wait for investment opportunities.

Since that next opportunity is not guaranteed to emerge quickly, your capital may go unused for some time.

You need to store money in a place where it will get competitive interest rate growth without sacrificing the other necessary characteristics (safety, liquidity).

What kind of growth does life insurance get?

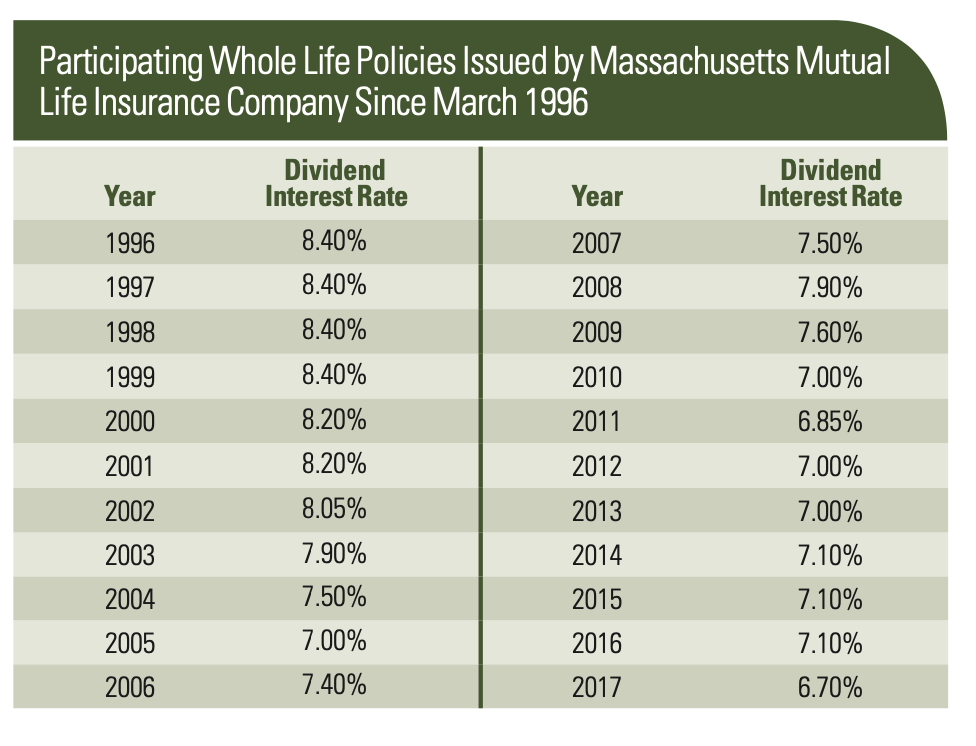

A study from 1996-2017 showed life insurance grew by an average of 7.58%.

That is pretty competitive growth.

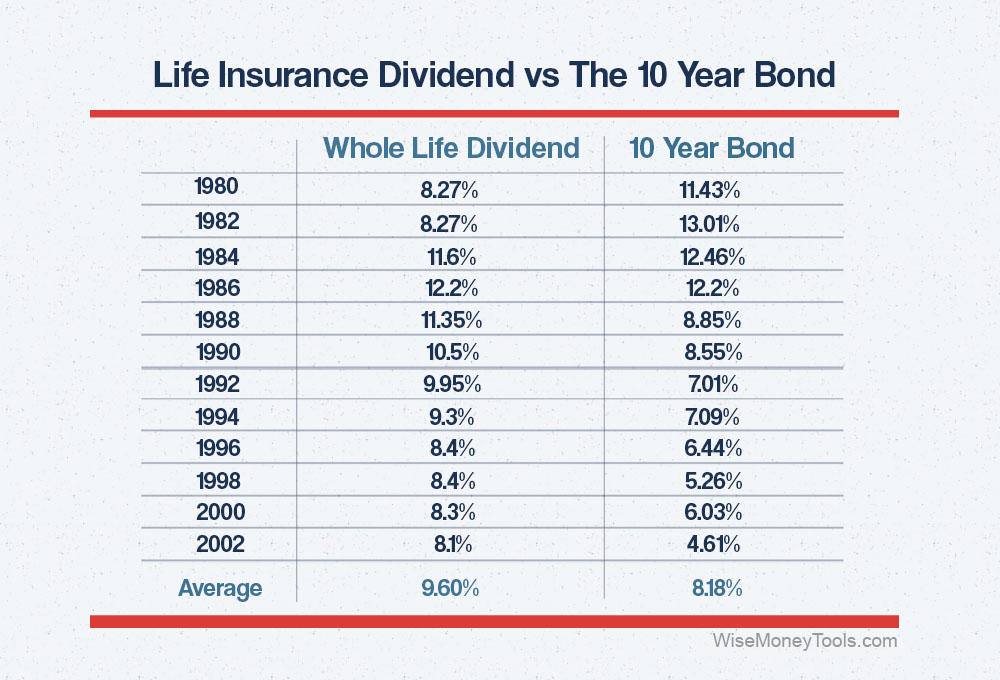

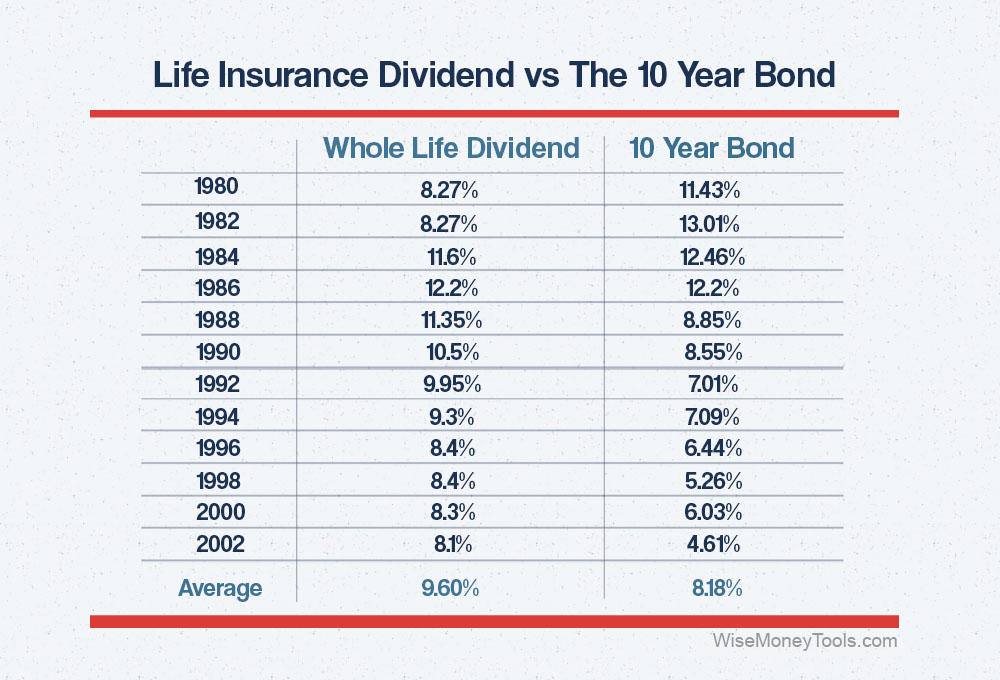

Compared to a 10-year bond from 1980-2002, whole life insurance grew at 9.60% against the bond at 8.18%.

With whole life insurance, you get better growth than a 10-year bond with all the added benefits. Compared to any savings vehicle–bonds, CDs, or a bank account–life insurance outperforms in most every case.

As for the dividend itself, many of these life insurance companies have been paying an annual dividend for more than a century. One more well-known company has paid a dividend every year since 1869.

Dividends are simply the earnings made by the life insurance company investments paid out to whole life insurance policyholders. They are the growth that you get when you own a policy.

But how do life insurance companies make this return?

How Life Insurance Companies Invest

Life insurance companies have a portfolio of investments where they keep their money. The National Association of Insurance Commissioners (NAIC) heavily regulates these investments.

Here is a look at the aggregate life insurance investment portfolio from a historical perspective.

[Aggregate Life Insurance Investments Image]

We see here that the typical life insurance investment portfolio contains (from greatest to least as a percentage):

- Corporate and Foreign Bonds

- Mortgage-Backed Securities (MBS)

- Treasuries and Government Bonds

- State and Municipal Bonds

- Cash and Short-Term Investments

- Equities

- Derivatives

- Real Estate

Based on this information, we get a general sense of where the dividend growth on our policy originates.

The benefit of your life insurance policy is you earn interest rates typical to a higher-yield investment, but with added benefits.

You still only use life insurance as the storage facility for your “personal bank” when it isn’t used for investments. However, you want to have the highest possible growth on this capital while you wait.

Then you can use this capital to make investments when they arise. This is where access to capital, or liquidity, comes into focus.

Benefit #3: Liquidity

Out of all of these characteristics, liquidity may be the most important. If you are storing capital to make a future investment, you need to be able to access capital quickly.

With cash value whole life insurance, you don’t take capital out of the life insurance policy like you do at a bank.

Instead, you take a loan from the life insurance company using your cash value as collateral.

It’s a straightforward process. But there are a few things you should know:

- Because this is a loan, your cash value will still be in the policy and growing.

- You will pay interest on the loan against your cash value.

- The interest you pay will be based on the expected annual growth projection.

- The difference between your interest paid and cash value growth is essentially a wash.

Because of regulations on life insurance, you use this process to access capital. It’s a slight complication but worth it for all the other benefits of whole life insurance.

You can always take a loan from the life insurance company against your cash value, but there are more options to consider.

Cash Value Line of Credit (CVLC)

Another liquidity option is to get a cash value line of credit, or CVLC, from a bank.

Because of the safety of whole life insurance, banks give these loans based on the cash value you have in your policy.

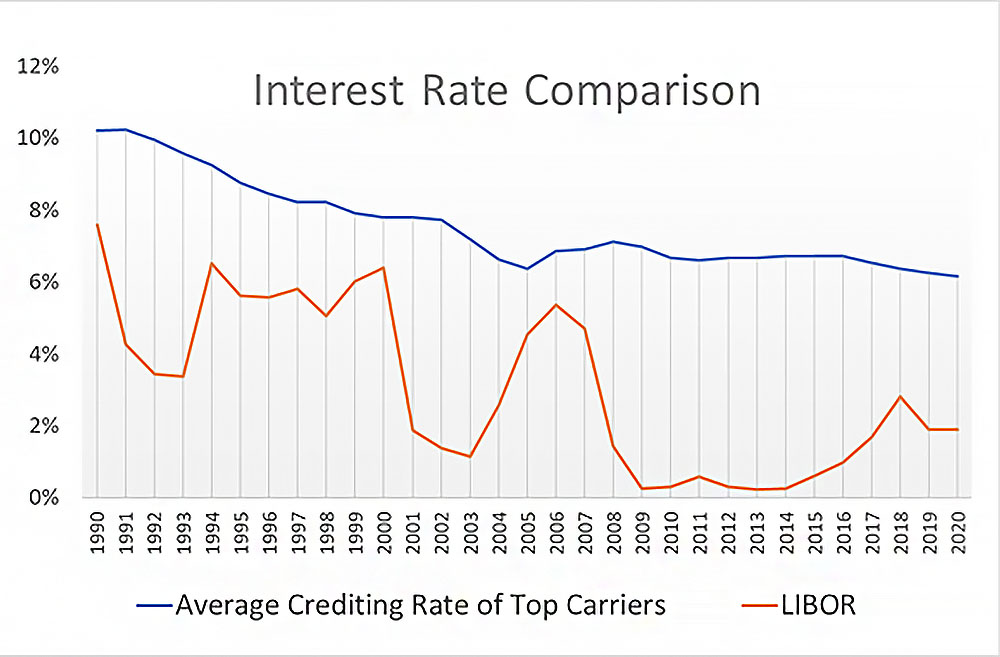

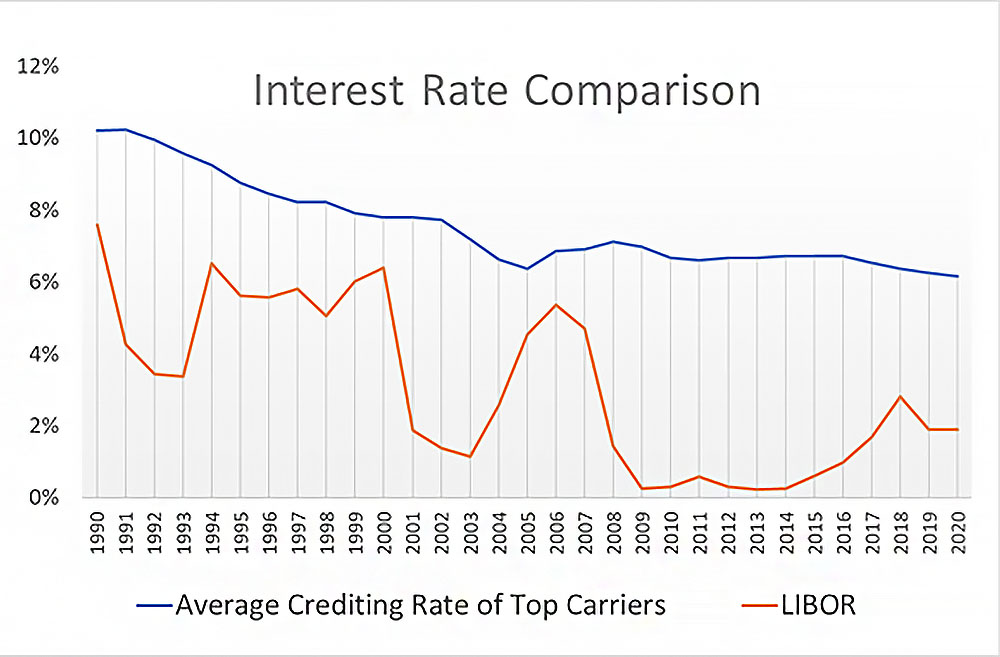

Historically, the interest you pay on the bank loan is lower than the dividends you earn inside your life insurance policy.

This is where the idea of leverage comes into play. Leverage simply means using borrowed money to make investments.

It starts to get interesting when you consider you earn more interest than you are paying on the same dollar.

There are a few different methods for accessing capital when you need it—another reason why Infinite Banking loves whole life insurance.

Benefit #4: Tax Advantages

Now to taxes. Taxes are a significant cost over your lifetime.

There are three ways taxes hurt you:

- Taxes lower your realized rate of return

- Taxes reduce your total invested capital

- Taxes decrease future compounding

Conversely, reducing taxes increases your overall compounding in these areas.

Life insurance dividends are tax-free. As long as you do not close your life insurance policy before you die, you will never pay taxes on that money.

Then, when you die, that money transfers tax-free in the form of insurance, as long as it doesn’t exceed estate tax regulations.

By keeping your money in your growing whole life policy, you avoid taxes on growth inside a life insurance policy.

The Impact of Taxes

If you look back at life insurance dividends against 10-year bonds, you can see the difference taxes make.

Let’s look at a real life example.

Assume an individual purchases a 10-year bond every ten years and holds them to maturity. Here is the interest rate they would earn.

- Year 0-10: 11.43%

- Year 11-20: 8.49%

- Year 21-22: 6.03%

In this scenario, bonds are getting a serious advantage by choosing higher return rates from history.

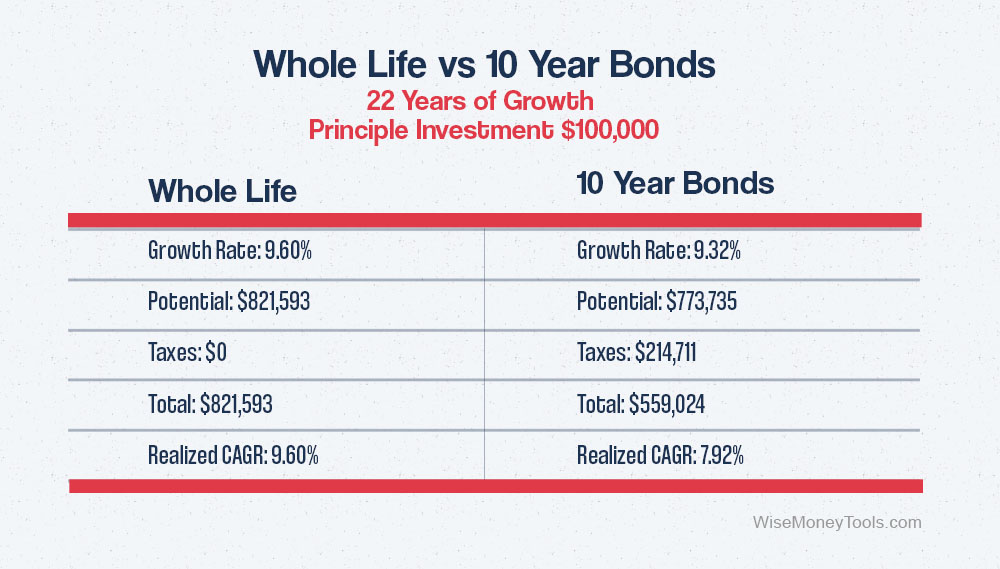

Let’s compare this to a whole life policy, both starting with $100,000.

With whole life you would have $821,593 after 22 years—an average of 9.60%.

With bonds before taxes, you would have $773,735. An average of 9.32% because you had the benefit of locking in these bonds at the high interest rates.

However, these bonds mature every 10 years–which is a taxable event.

In total, you would pay $214,711 in taxes.

This leaves you with $559,024.

You lose 38.41% of growth potential because of taxes and lost compounding opportunity.

The money paid to taxes causes the most damage by losing out on compounding potential.

This is another reason whole life insurance is preferred for Infinite Banking. Taxes are a major lifetime cost. By reducing taxes you increase compounded returns significantly.

Benefit #5: Life Insurance

Your life insurance death benefit won’t impact how you use your whole life insurance policy–it’s just an added benefit.

But it’s a substantial benefit.

First, along with tax advantages, life insurance is how your family or beneficiaries can avoid taxes when you die.

Life insurance transfers income tax free at death. If you plan to transfer over a million dollars or more, depending on the state you live in, you may need estate tax planning to further increase the tax savings.

Second, when you use a whole life policy for Infinite Banking, you might not need to invest in term insurance. The insurance benefit from your whole life policy saves you money on insurance coverage over your lifetime, even if it’s only $500-$1,000 a year.

Over your lifetime, the compounded savings could mean another $100,000 to $200,000 more for your retirement.

Insurance is the last of the five benefits you get from whole life.

With that, you have a good idea of why whole life insurance is the primary choice for those using the Infinite Banking Concept strategy.

There are more benefits with whole life compared to other potential products to store money and create your “personal bank.”

Infinite Banking: Investing and Synergies

Now let’s look at the investing side of Infinite Banking.

After all, making intelligent investments and growing your wealth is the purpose of Infinite Banking.

Ultimately, the goal is to acquire investments that produce strong cash flow while investing in a way that fits your personality and risk tolerance.

Let’s look at a few of the may ways you can use this strategy.

Leveraging Life Insurance

Because this may apply to multiple investment strategies, let’s start with leveraging life insurance.

We covered buying whole life insurance then taking loans from the bank at an interest rate lower than you’re earning.

This is called the spread.

For example, if you earn 5% in a life insurance policy and you can borrow money from the bank at 3%, then you are making 2% on the spread between the interest cost and the earnings potential.

As you can see from the chart above, 2% has been the historical spread between the whole life dividend and the CVLC from the bank.

The leverage life insurance strategy goes like this:

- Fund a life insurance policy

- Wait for cash value to be available

- Take a CVLC loan against cash value

- Fund another life insurance policy

- Repeat

This is how you can leverage life insurance by borrowing money from the bank at a lower interest rate and putting that money to work in more life insurance policies.

It takes time for cash value to become available, limiting the rate at which you can start new policies. Nonetheless, over time you can potentially get double-digit returns with this strategy.

It’s an effective strategy. The trade-off is that your capital is tied up and won’t be available for other investment opportunities. This strategy is the investment.

Starting or Running a Business

It’s hard to ignore that starting a successful business will increase your cash flow at a level that most other investments cannot.

Whether you create a small side hustle or the next great tech giant, starting a business takes capital.

With Infinite Banking, you keep capital available in your whole life insurance policy. Then, when you are ready, you can start putting that money to work in your business.

Moreover, while running your business, you can keep money in a whole life insurance policy where it can grow until you have new opportunities to expand.

The point is to earn competitive growth in whole life insurance, then leverage against the policy for capital to start a business.

And life insurance is liquid, giving you options. You may not want to start a business today. But that could change. Infinite Banking gives you the ability to take advantage of future business opportunities that you may not be considering today.

Added Synergistic Benefit–Interest paid on a loan used for business purposes is tax deductible. There is an added tax benefit from using whole life insurance to fund business opportunities.

Real Estate Investing

Another common Infinite Banking strategy is investing in real estate. Money is stored in your whole life insurance policy while you wait.

When the time is right, you have money available to make down payments or fully fund purchases, depending on your strategy.

Then, you use cash flow from the property to pay back policy loans and prepare for the next opportunity.

Added Synergistic Benefit–Interest paid on a loan used for investment purposes is tax deductible. There is an added tax benefit from using whole life insurance to fund real estate investment opportunities.

Another Synergistic Benefit–Interest earned on a life insurance policy is higher than other savings vehicles. Money is working for you already at a decent rate of return. Investors are more patient when searching for opportunities and won’t feel rushed to take the first available deal.

60/40 Bond and Stock Investing

Many investors, including Ben Graham, suggest having a certain portion of a portfolio in bonds.

Whole life insurance gives you an edge in the bond portion of your portfolio with the benefit of higher growth, tax advantages, liquidity, etc.

You could even dedicate the bond portion of your portfolio to the leveraging life insurance strategy to potentially increase returns further.

Also, another strategy would be to store a potential stock portfolio in whole life insurance and then take money out when obvious investments are available.

Other Investments

There really is no end to the creative possibilities. It really depends on you and what you are looking to accomplish.

Your investments could be in art, rental vehicles, websites–anything that could earn substantial returns or cash flow. Infinite Banking is about having a place to store capital and then taking advantage of opportunities.

Now that you better understand Infinite Banking, let’s look at some of the downsides of this strategy.

Downsides of Infinite Banking and Whole Life Insurance

As with any strategy, there are downsides. Let’s look at the downsides of Infinite Banking and whole life insurance.

Fees and Cost of Insurance

Life insurance is criticized for having high fees.

This is true to an extent.

The fees in a whole life insurance policy go to pay the cost insurance.

Due to the insurance cost, it takes time for our cash value to become available for use.

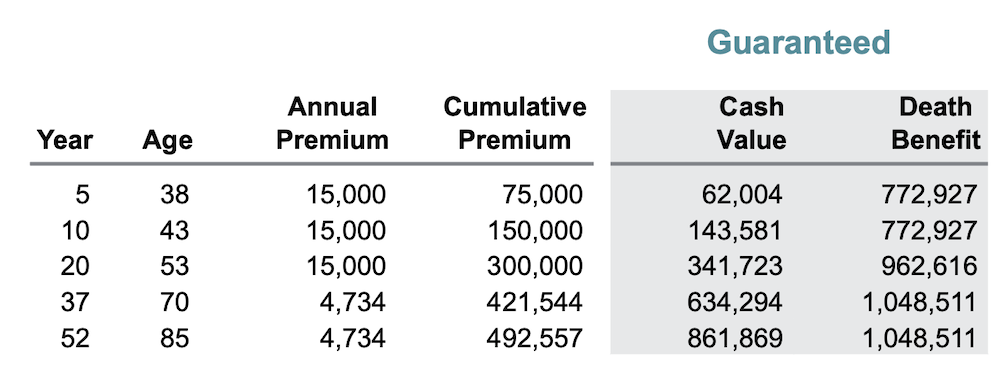

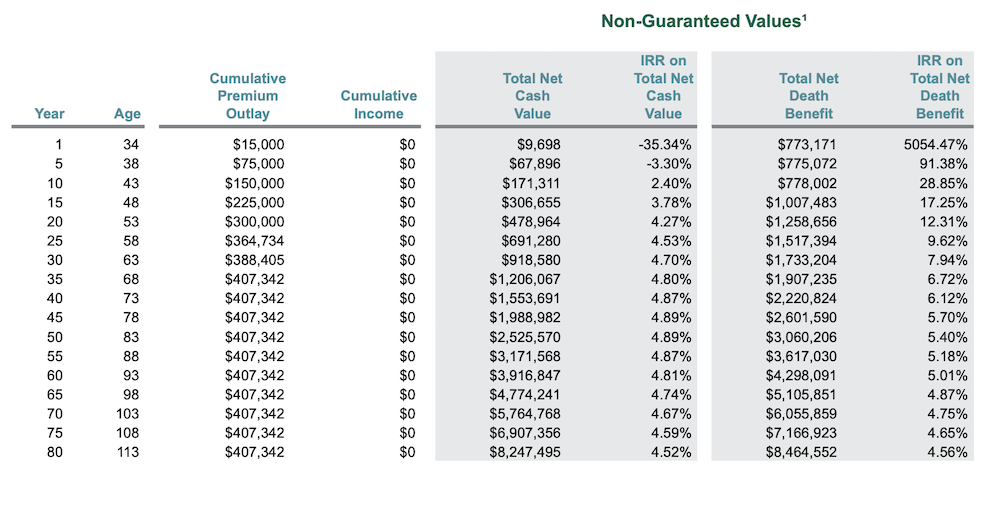

Here is the general cash availability by year, as seen in this Infinite Banking policy illustration (above).

- Year 1: 50-65% of premiums available as cash value.

- Year 5: 85-95% of premiums available as cash value.

- Year 10: 105-110% of premiums available as cash value.

- Year 15: 120-130% of premiums available as cash value.

- Year 15+: Continuous growth based on dividends.

Eventually, all the premiums you pay into a whole life insurance policy become available. But because of the cost of insurance, this process takes time.

Consistency and Payments

To maximize a life insurance policy’s efficiency, it must be carefully structured. This is done by creating each policy with a target annual payment in mind.

When a policy is first constructed, your target premium ensures the cost of insurance is as low as possible.

A policy structured to for $50,000 a year in premium will be most efficient when $50,000 a year is put into the policy–especially during the first ten years.

When you want to put more money into life insurance, you will apply for a separate policy with its own premium.

The premium amount does not matter; you can choose any amount you want. Consistency is what matters.

Because a portion of your payments goes to insurance and you must consistently pay this cost, saving money with life insurance can be more difficult than putting money into a bank account.

Qualifying for Life Insurance

Because we are using a life insurance product, someone must qualify for insurance.

If you have major health conditions or are in advanced years, it may not be cost-effective to put this insurance on your life.

The workaround is simple. You can still be the owner of the policy without being the insured.

If you are not the insured, then there will be no death benefits paid when you die. The policy ownership would transfer to the person of your choosing, and the cash value and other benefits transfer with it.

You can put the life insurance on a family member, or even potentially a business partner, and still get the living benefits of the policy–growth, safety, and tax advantages. However, the insurance policy will not cover you.

Maximum Insurance Limitations

Life insurance companies also have a set maximum amount of insurance on any one individual. The amount of insurance usually decreases with age, so you can’t get as much when you are older.

This limitation is usually around 20-30 times your annual income, depending on your age.

When leveraging life insurance policies you will eventually run into the maximum amount of insurance you can buy.

The workaround is creating policies to insure other family members or business partners. There are also ways to invest in cash value by purchasing policies from others who no longer want or need them.

These downsides mean whole life insurance takes more planning and forethought to maximize the benefits for investors.

Infinite Banking Creates Intelligent Investors

Is Infinite Banking good or bad? Realistically, it depends on how you use it. However, the purpose of Infinite Banking is to create better investors. And it can be a very effective strategy for accomplishing this goal.

Infinite Banking gives you options. With accessibility, growth, and safety–you can start with a plan of being an investor today and look to start your own business tomorrow.

It’s about being a better investor, but also being able to grow and change as a person.

Infinite Banking is about possibilities.