The best way to understand Infinite Banking, what it does, and how it works is to look at an Infinite Banking example with a whole life insurance policy illustration.

In this article, let’s briefly overview Infinite Banking, then look at a typical Infinite Banking Concept policy example. Lastly, let’s explore more advanced examples of applying the Infinite Banking Concept to grow wealth.

Infinite Banking: An Intelligent Investing Strategy

Before getting into the specific Infinite Banking examples, let’s briefly overview the Infinite Banking Concept.

The purpose of Infinite Banking is to preserve capital in a high-growth savings account. Then, when smart investment opportunities present themselves, you access capital from the savings account to make higher-return investments.

To do this, you must have a savings vehicle with three specific characteristics:

- Liquidity–You need access to capital to take advantage of investments when available.

- Capital Safety–Typically, good investment opportunities arise during times of market turmoil. If you are down 50% of your principal, you may not have the money, or the stomach, to buy depressed assets.

- Competitive Growth–No one knows when a good investment opportunity will be available. You want the highest potential growth possible from this savings vehicle while you wait.

This is why Infinite Banking uses whole life insurance. It’s the savings vehicle that best provides those features.

Let’s review why whole life insurance works best.

Infinite Banking and Whole Life Insurance

The qualities central to Infinite Banking are liquidity, safety, and growth.

Most investments lack these characteristics.

CDs, IRAs, and 401ks aren’t liquid–meaning you can’t access your capital to purchase assets.

You have liquidity with bonds, stocks, and mutual funds. However, you could lose a substantial amount of money if you have to sell. They don’t offer the safety you need.

Then you have bank savings accounts. They are liquid and safe. But they do not offer competitive growth rates.

Usually, the list of options ends here. But an often overlooked investment vehicle is whole life insurance.

Whole life offers:

- Access to Capital–Typically, the best way to access capital in life insurance is through policy loans. It’s a simple process that makes capital easily accessible.

- Safe, Guaranteed Growth–Life insurance offers a contractual minimum rate of return.

- Competitive Interest Rates–These policies currently grow around 5%, with historical rates as high as 8% or more.

- Tax Advantages–Life insurance growth through dividends is tax-deferred. As long as the policy is not terminated before you die, you avoid taxes indefinitely.

- Death Benefit–When you die, the net insurance portion of the policy transfers income tax-free to your heirs.

These advantages give you everything you need to implement the Infinite Banking Concept effectively.

For this article, this information is all we need to continue. You can get more in-depth information on the Infinite Banking Concept in our guide here.

Now, let’s get into our primary Infinite Banking example before looking at more advanced examples.

Infinite Banking Concept – Example Policy

Let’s look at a basic whole life insurance policy set up for the Infinite Banking Concept and then go through some details.

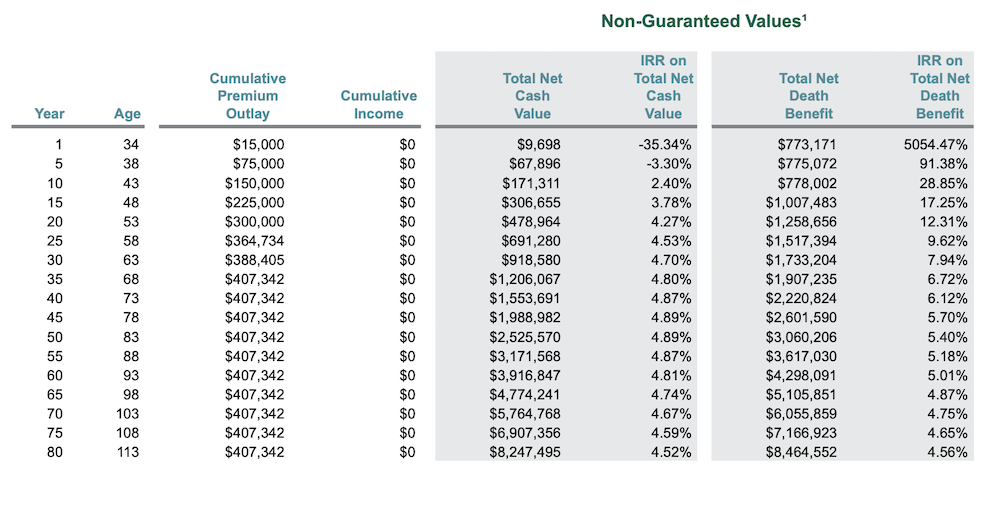

Above is a classic example of a whole life insurance policy used for Infinite Banking.

Here are the details of this example policy explained:

- Year: Number of policy years; this is broken down into five-year increments to make it more condensed.

- Age: Age of the individual, starting at 34 years old.

- Cumulative Premium Outlay: The amount contributed to the policy in aggregate. This individual contributes $15,000 annually until their late 50s when they taper down. Contributions stop at 65.

- Non-Guaranteed Values: These are projected values based on today’s dividend rate. These values will adjust based on the insurance company and investment conditions.

- Total Net Cash Value: The projected amount of cash accessible for loans.

- IRR on Total Net Cash Value: The projected internal rate of return (IRR) on the cash values by year. The current dividend rate projection is around 4.8% annualized.

- Total Net Death Benefit: The projected death benefit, or the life insurance payout in case of death, by year.

- IRR on Total Net Death Benefit: The projected rate of return on the death benefit if the insurance policy were to pay out.

- Guaranteed Values (Not Pictured): Each policy illustration also has a set of guaranteed values. These are not projections but the minimum guaranteed values contractually obligated to the policy owner.

You see why whole life insurance is compelling compared to other savings vehicles. The overall annualized growth rate takes time to achieve. However, it is typically much higher than other investments.

Combine that with the liquidity, safety, and tax advantages, and whole life insurance becomes compelling.

But these policies alone are not the point. It is more valuable to look at examples of Infinite Banking when used for investing or other purchases.

Let’s start with the classic Infinite Banking example of buying a car–a liability–and then look at more compelling examples of buying assets and using leverage to accelerate growth.

Infinite Banking Example: Purchasing a Car (Liability)

Nelson Nash, the originator of the Infinite Banking Concept, used the example of buying a car in his book Becoming Your Own Banker.

Let’s look at this example of buying a car in more detail.

Assume you will purchase a car for $50,000 every five years over your working life–call it 45 years.

Let’s look at how a car is typically purchased with cash:

- Save up money for five years

- Purchase the first vehicle

- Begin saving money to make the next purchase

- Repeat

At the end of 45 years, you have a $50,000 balance in your account and you have purchased seven vehicles over your lifespan.

But all that capital and interest could have created substantial growth over those 45 years.

This is called opportunity cost. By purchasing cars with cash, you miss the total growth potential of your money.

Infinite Banking looks to capture this lost opportunity cost by slightly adjusting how you make these purchases.

Taking Loans Over Paying Cash

So how do you capture lost opportunity cost?

This is where the idea of “banking” comes in.

Infinite Banking says that you treat your money like you are the banker. Instead of spending cash, you lend money to yourself and pay that back as if you are the borrower.

Let’s examine the process of using whole life to buy these vehicles:

- Save up money for five years in a whole life policy

- Take a loan from the policy to buy a car

- Pay that loan back over a five-year period

- Repeat

By saving money in a whole life insurance policy and taking loans against the cash value, the original $50,000 grows without interruption. It is constantly compounding.

At the end of the 45-year period, at the 4.8% growth rate, you have $290,818 in your policy.

That’s a big difference compared to paying cash.

This is the traditional way Infinite Banking uses whole life insurance. It’s an effective strategy.

However, there are a few flaws worth pointing out.

- It’s still your money – At the end of the day, you are simply taking money from your income and putting it into your savings. This concept leads some to think Infinite Banking is a scheme, not a legitimate financial strategy.

- Cars are liabilities – What if you purchase cash-flowing investments instead of liabilities?

Let’s consider some Infinite Banking examples and strategies that may be more effective for creating wealth.

Infinite Banking Example: Purchasing Cash Flow (Asset)

For this first advanced Infinite Banking example, let’s introduce the concept of buying a cash-flowing asset and using safe leverage.

In our previous example, you purchased a car. A car is a liability. It loses money over time and earns you no cash flow.

You also aren’t increasing your wealth because the cash you paid back into your policy came from your regular income.

This is a less effective wealth-building strategy. Let’s consider the intelligent investing approach of buying cash-flow-producing assets that pay you to own them.

The process here is as follows:

- Build up policy cash value

- Borrow against the cash value

- Purchase cash-flowing assets

- Use cash flow to pay back loans

For this strategy, you can put any cash-flowing asset here–a business, real estate, or even a dividend-paying stock.

Anything that will pay you a cash flow greater than your interest expense.

Buying Cash-Flowing Assets

Let’s compare buying cash-flowing assets using your cash value to the previous example of buying a liability.

With the car, over a 45-year period, you have a $290,818 cash value.

Now let’s purchase a rental property with that money.

You save up $50,000 in your policy during the first five years to make a downpayment on the property.

That money becomes your 20% downpayment on a home worth $250,000.

You collect rent from the property and use it to pay the bank for your mortgages, make payments on your policy loan, and use any remaining income for maintenance on the property.

If you aren’t making at least enough to pay for these costs, then it’s not a smart investment.

At the end of 35 years, the home is paid off. Now the entire rent payment is saved into a new life insurance policy for the remaining 10 years.

Lastly, assume the home appreciated at 2% a year.

At the end of the 45 years, you have:

- Property – $552,009

- Insurance Policy #1 – $290,181

- Insurance Policy #2 – $186,829

- Total Value: $1,029,019

You’ve grown your wealth by $1,029,019 from purchasing assets compared to $290,818 from buying liabilities.

The difference is substantial because assets appreciate, retain value, and pay you cash flow to own them.

Added Tax Advantages

On top of this, there are important tax advantages to note.

Depreciation is the process of reducing taxable income by expensing the cost of an asset over its usable life.

Real estate depreciates at 3.636% over 27.5 years, meaning you would reduce your taxable income by $9,090 every year.

Also, interest paid on a loan for investment purposes is also tax-deductible. Over the lifetime of both loans, you would have $247,220 of tax-deductible interest payments. Taxes are the most significant expense you will pay over your lifetime, reducing this expense through cash-flowing assets means even more money in your pocket.

Lowering Your Cost of Capital

Before jumping into the next Infinite Banking example, let’s look at the cost of money and how lowering interest rate expenses can positively affect investment outcomes.

The life insurance company gives you a loan based on the projected earnings in the policy.

But what if you could get a lower interest rate on that loan?

Doing so would give you the advantage of earning a spread.

A spread is the difference between the interest rate paid on borrowed money and the interest rate earned on the assets purchased with those borrowed funds.

A life insurance policy is meant to be a wash. The interest rate you earn in the policy, and the interest rate you pay on the loan, are typically very close.

So you must look outside the life insurance company to achieve this spread.

This is where you look to the bank.

Cash value in a life insurance policy is a safe asset. You can get a loan from a bank using cash value as collateral.

Cash Value Line of Credit

It’s called a CVLC or cash value line of credit.

The benefit is that the interest rate the bank charges you is often lower, or much lower, than the interest you earn in the life insurance policy.

Where the life insurance company charges you around our growth rate, in this case, 4.8%, banks often charge you 1-2% lower.

The spread adds to the benefit of the above example of purchasing real estate. Over that 40-year compounding period, you would save an additional $184,948 in interest for every 1% reduction in interest rate cost.

This is one of the main strategies we use at Wise Money Tools. Let’s review the added benefits here:

- Added Benefit #1: Buying Assets–Putting your money into investments instead of liabilities allows you to grow wealth by paying back loans with asset cash flow.

- Added Benefit #2: Earning a Spread–Borrow from the bank at a lower interest rate than you earn to increase gains.

- Added Benefit #3: Tax Advantages of Loans–Deduct interest costs on business or investment purchases to save money on taxes.

- Added Benefit #4: Asset Depreciation–Deduct the total cost for real estate and other assets annually over the usable life.

These benefits make Infinite Banking and whole life insurance a powerful investment strategy.

Before we conclude, let’s look at our last Infinite Banking example using leveraging and the interest spread to grow wealth.

Infinite Banking Example: Leveraging Into Life Insurance (Asset)

This brings us to our last strategy, using multiple Infinite Banking policies to leverage and grow money safely.

The leverage strategy takes advantage of the spread between the loan from the bank and the interest earned on a life insurance policy.

Here is the process:

- Fund a life insurance policy

- Wait for cash value to be available

- Borrow against it from the bank

- Use the borrowed capital to fund an additional policy

- Repeat

Typically, leverage is a double-edged sword. When investments go up, they magnify to the upside. But when they go down, the losses magnify as well.

It’s a dangerous game.

However, life insurance is a safe, predictable asset. It doesn’t come with the downside risk of more volatile assets.

Life insurance has guaranteed minimum returns–it doesn’t lose money.

Anywhere else this strategy would not work safely.

Through this approach you get the advantage of:

- Increased guaranteed values

- Higher dividend growth

- More death benefit

- All tax advantaged

The strategy takes time to build. However, as time goes on more cash value is available to borrow against. This begins to snowball into high, potentially double-digit growth rates.

The leveraged insurance strategy is another way to build wealth through Infinite Banking.

Infinite Banking revolves around life insurance because it offers you safety, competitive returns, access to capital, and tax advantages.

Smart Bankers Use Safe Leverage

Infinite Banking looks to increase wealth through smart investment principles. It is a powerful concept.

But buying assets instead of liabilities makes these Infinite Banking examples even more attractive.

By implementing the strategies–the spread, buying cash-flowing assets, and applying safe leverage–you can compound our money in ways not traditionally taught by Wall Street and most financial advisors.

Want to learn more about banks and leveraging life insurance? Watch the Wise Money Tools two-part video series, “How Banks Make Money,” below, or contact us here.