Is Infinite Banking a scam, a legitimate investing strategy, or somewhere between? Unfortunately, with so much noise about the Infinite Banking Concept, it can be hard to tell.

And some very respected individuals talk a lot about how bad Infinite Banking is.

Are they right?

In this article, we dive into some of the arguments, questions, and concerns about the Infinite Banking Concept, and why some say Infinite Banking is a scam, to see if we can uncover more about the concept.

The Infinite Banking Concept – A Quick Overview

When explained poorly, which is often the case, Infinite Banking sounds complicated. However, it doesn’t need to be. At its core, Infinite Banking is nothing more than overfunding a whole life, or sometimes a universal life, insurance policy to maximize cash value growth.

Then, you access this capital from the whole life insurance policy when smart investment opportunities become available.

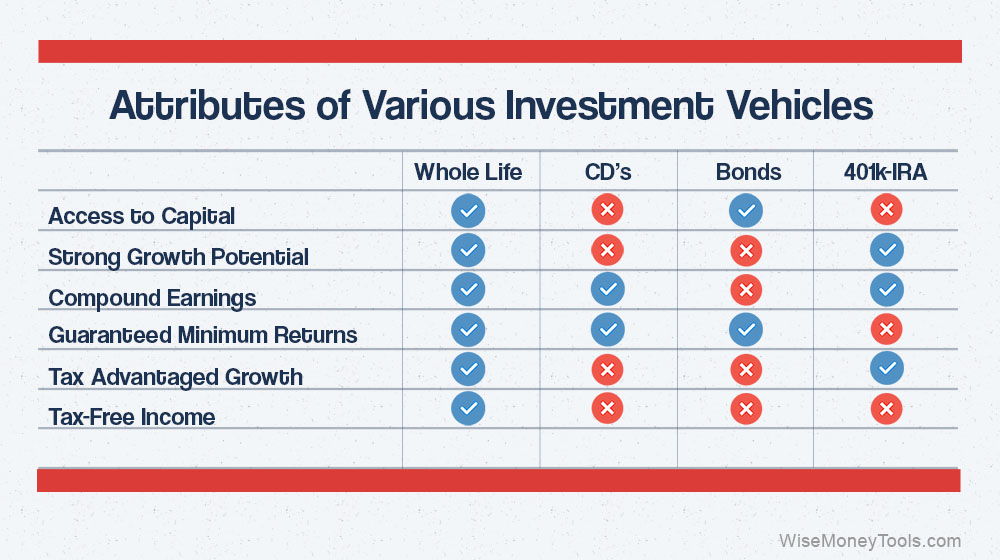

When done correctly, beneficial characteristics–like tax advantages, guarantees, and access to capital–are available to you, in a whole-life policy, that are not typically found in other savings or investment products.

Does that mean it’s better or worse than other investments? Well, that’s for you to decide.

The basic structure of Infinite Banking has been around for a long time. Before it was called Infinite Banking, it was simply an overfunded whole life insurance policy–often done with a 10-pay policy.

Then, in the 1980s, Nelson Nash, author of the first book on Infinite Banking, saw the underutilization of whole life insurance–especially for business owners and investors.

He dedicated his life to figuring out how to amplify these characteristics in a whole life insurance policy by structuring and funding the policy with a more aggressive approach to building cash value.

That’s a quick overview of Infinite Banking.

Concerns About Infinite Banking as a Scam

Now, let’s look at some of the concerns around Infinite Banking and some of the arguments as to why Infinite Banking is a scam.

“Whole Life is an Awful Insurance Product”

A common belief in finance is that whole life insurance is all-around awful. It provides no real benefit while the insurance agency lines its pockets.

This leads to the claim that Infinite Banking is simply a cover to sell whole life insurance.

The truth is, it depends on how you use whole life insurance.

If you are comparing whole life insurance with term insurance for the insurance coverage, term is better and cheaper.

In the context of a stock portfolio or a 401k, term insurance makes a lot of sense.

Whole life, purchased only for insurance coverage, doesn’t offer much of a benefit for the cost.

However, things change if you consider whole life insurance as a savings vehicle.

A properly structured, Infinite Banking whole life policy offers:

- Competitive Growth

- Safety

- Access to Capital

- Tax Advantages

- Death Benefit

The insurance is just a byproduct of using whole life for Infinite Banking.

Compared to other savings vehicles, whole life is much more efficient. This is the reason Infinite Banking uses whole life insurance. It’s the best tool for the job.

“Dividends Aren’t Growth, Only a Refund of an Overcharge”

One of the reasons some call Infinite Banking a scam is because of how the IRS handles dividends.

The argument is, “Dividends are a refund of a deliberate overcharge.”

If you aren’t familiar, when life insurance companies earn money, they can pay those earnings back to their owners through a dividend.

If you have previously owned stocks, it works similarly with a life insurance policy. These dividends are not guaranteed, but many companies have paid a steady dividend for hundreds of years. One prominent company paid a dividend every year since 1869.

The argument is that the life insurance company overcharges you and then pays you back that overcharge as a dividend. Then they act as if that benefits you.

But, if these returns are only refunds of an overpayment, then the policy would never actually grow.

You can’t grow money by going to the store, buying an item, then returning the item for a refund.

A refund cannot be growth.

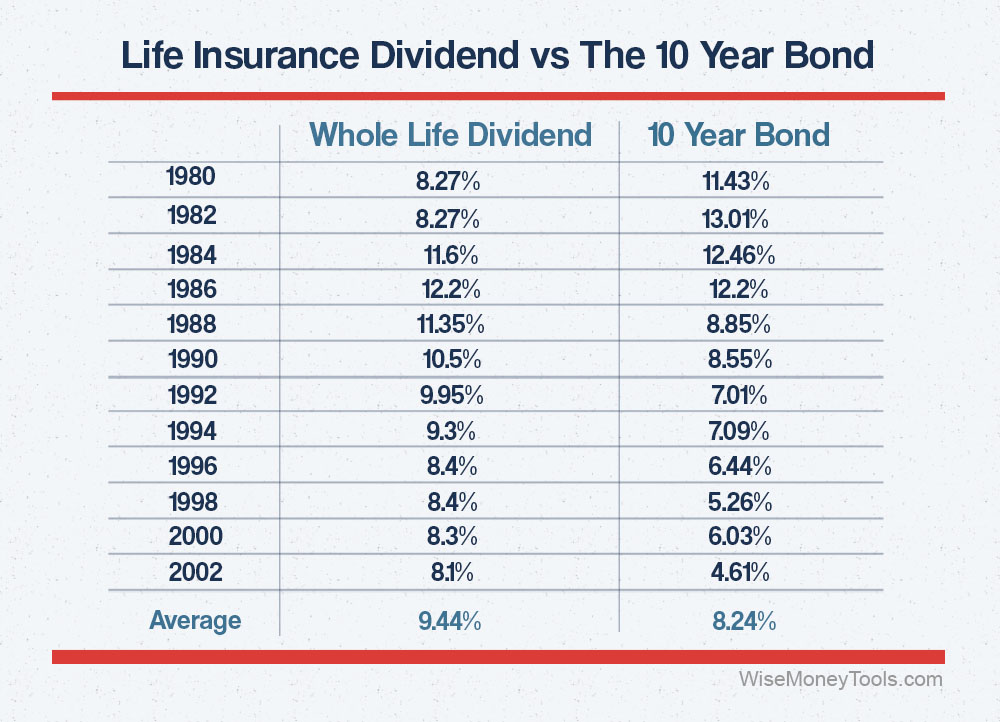

If a whole life policy, or Infinite Banking policy, has a historically 8.61% annual growth rate, then that growth must come from somewhere.

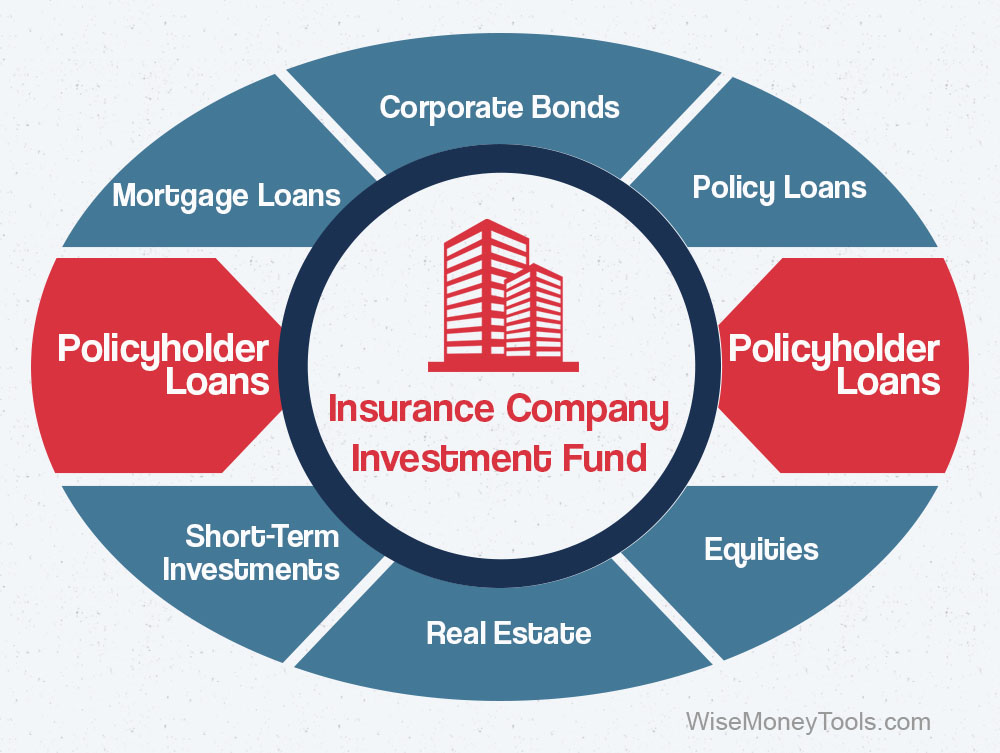

The reality is, the dividend in an insurance policy ties to earnings, not growth.

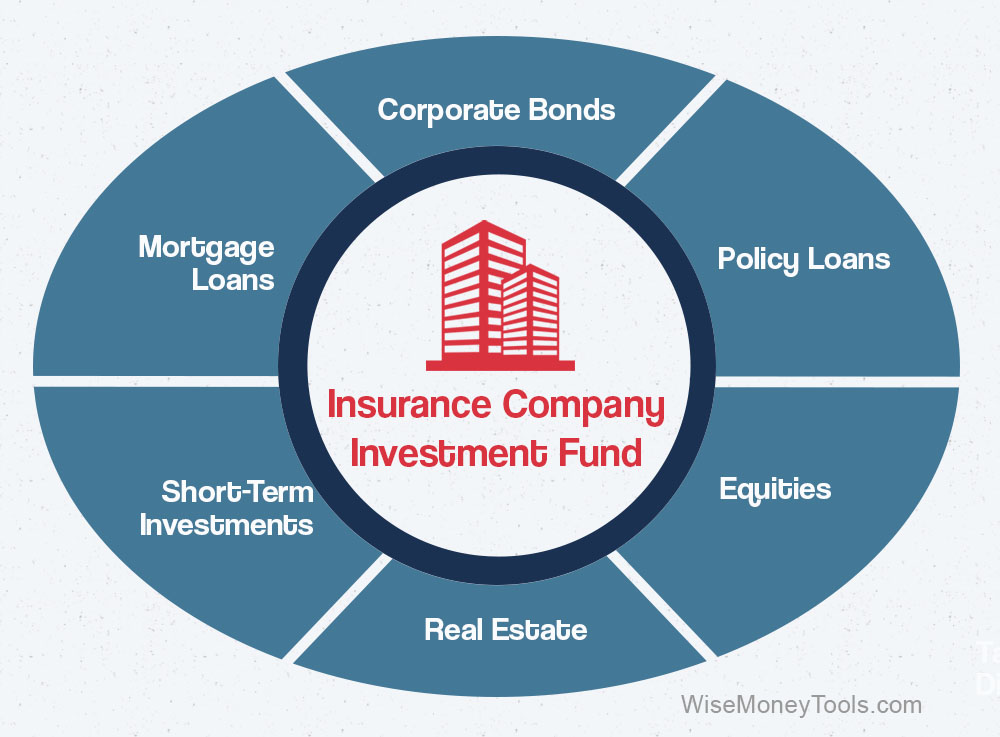

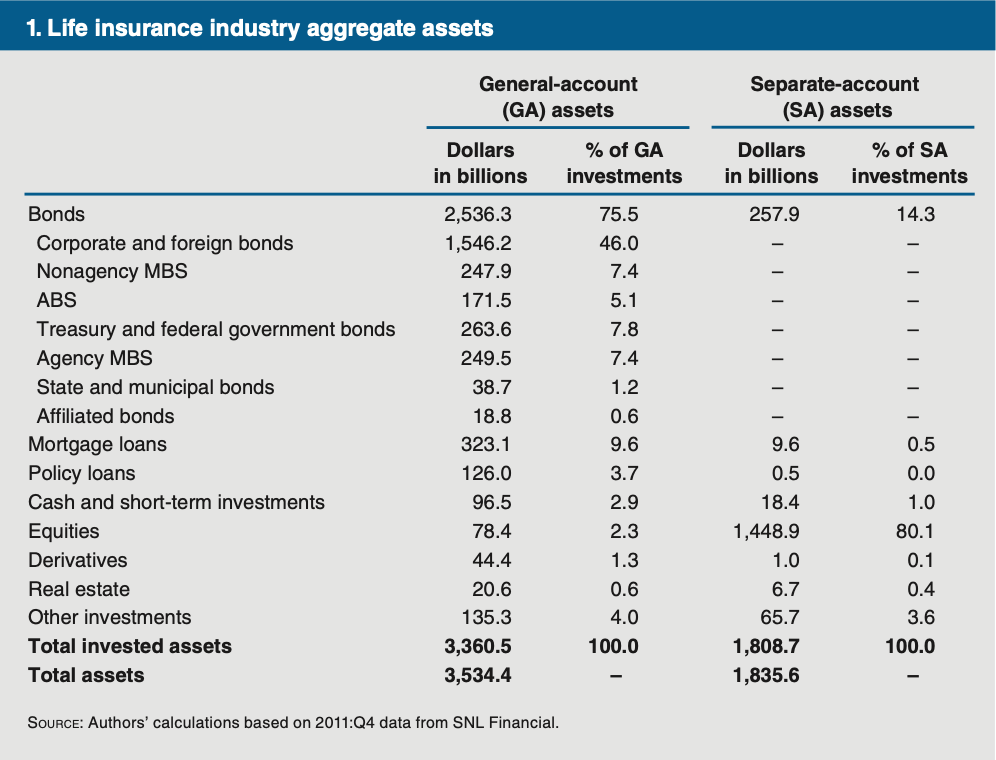

Insurance companies invest billions of dollars in bonds, real estate, and other safe assets. They make money and give it back to the policyholders through dividends.

The only difference is that those dividends are not taxed when an insurance company does it. So shareholders receive that without creating a taxable event.

It just doesn’t make sense to call dividends a refund of a deliberate overcharge. Life insurance companies make money. Then they distribute those earnings to policyholders through dividends. That’s where the growth comes from.

“All of Your Cash Value Dies With You”

Another argument for why Infinite Banking is a scam deals with the face value vs. cash value.

“All the cash value dies with you. When you die, you only receive the face value, or death benefit, and all that cash value vanishes.”

Quickly, what do these terms mean?

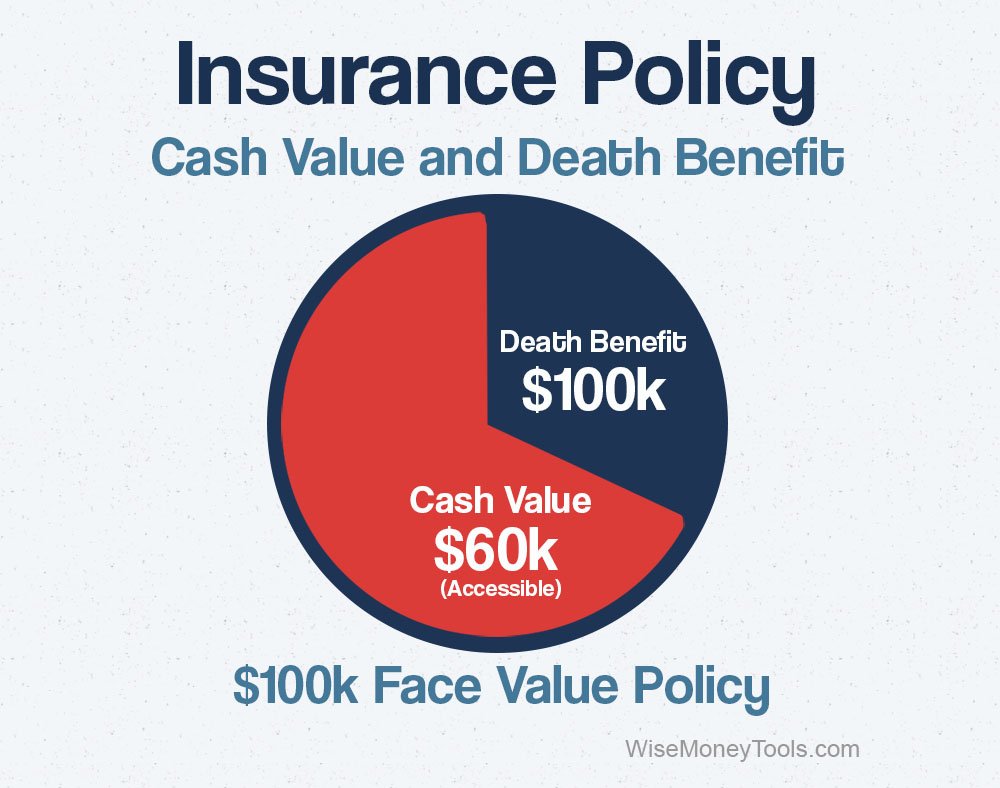

Face Value, or death benefit, is the money your beneficiaries get when you die, or the policy matures.

Cash Value is the amount of money you have available to borrow against or liquidate from the policy.

Fortunately, a bit of education clears this up.Face value and cash value are no different. They are the same thing. Cash value is nothing more than a portion of the face value, or death benefit.

Cash value is the amount of the face value that is accessible to the policy owner to borrow against or liquidate.

The way the argument is formed makes it sound like there would be a time when the cash value would exceed the death benefit and that, if somehow you died in that scenario, all that cash value would be lost.

But cash value would never be more than the death benefit; it’s always less. It’s a portion of the death benefit. When you die, that death benefit, or face value, transfers, income tax-free, to your beneficiaries.

Once again, the argument makes it seem much worse than it is. But it’s simply a nonstarter once you understand the functionality of whole life insurance.

“Paying Interest on Your Own Money is a Waste!”

“It’s Infinite Banking for them, not for you.”

In an Infinite Banking style life insurance policy, you don’t liquidate the money from your policy. Instead, you take a loan against the policy cash value and pay that loan back to the insurance company with interest.

The argument here is that because you are paying your money back with interest, it doesn’t benefit you; it only helps the insurance company. You lose, they win.

This is another reason people dislike Infinite Banking or call it the Infinite Banking scam.

However, there are really three questions here about life insurance policy loans that I want to address.

- Why would I want to pay interest on my own money?

- Is there a benefit to paying myself back with interest?

- Why can’t I just liquidate my cash value and put it back in?

“Why would I pay interest on my own money?”

When you take a loan, the life insurance company charges you interest.

However, the life insurance company is charging this interest for a reason.

This all comes down to the life insurance company’s investment fund and what that investment fund earns.

See, when you take a loan from the life insurance company, your cash value continues to grow inside your policy.

So, if the life insurance company thinks that they, and you as a policyholder, will be making around 5% (the current rate) that year on their investments, then they charge you 5% on the loan.

As the life insurance company, it doesn’t matter whether they earn 5% on bonds that year or 5% from a secured loan to a policyholder–either way, it’s the same for them.

And it’s basically the same for you.

In this scenario, you borrow money from the policy at around 5%, and you earn around 5% in the policy on the cash value. Simply put, it’s a wash.

That’s because it’s meant to be a wash. It’s not meant to be some way for the life insurance company to profit from you.

However, contrary to the initial reaction, this is a benefit. That’s because there can be tax advantages to paying interest on a loan–primarily when used for investing or business purposes.

That’s a little more of an advanced concept. However, it is good to note.

“What is the benefit to paying myself back with interest?”

There is also a benefit to having your money constantly compounding, even when using it.

This is where the Infinite Banking philosophy comes in. One of the fundamental principles of this philosophy is–always be compounding.

The idea is simple. If your money compounds at 5% for half of your life vs. all of your life, the difference is dramatic.

Let’s look at an example starting with $100,000 in capital.

In 60 years, if you only compounded half the time, you would have $432,194.

Compare that to having $1,867,918 if you had been compounding the entire time.

So, if you want to use the money to buy a car, buy a business, or invest in a real estate purchase, that money has a cost. And you want to pay that cost back to yourself as interest.

Whether it is framed as “borrow from yourself and pay yourself back interest” or “borrow from the life insurance company and let your money continue to compound,” the result is the same. Your money is continuously compounding, and you do not get in the way of your future growth potential.

“Why can’t I just liquidate my cash value and put it back in?”

This is a good question. You don’t want to liquidate cash value, not because you can’t, but because it is difficult to put that money back in.

That’s because of regulations placed on whole life insurance.

Getting money into a life insurance policy is actually a bit difficult.

In the past, the government wanted to stop wealthy individuals from easily transferring money in and out of a life insurance policy for the tax advantages.

So they set up some rules.

They made it so individuals have to put money into a life insurance policy cash value over time, not just all at once.

They created this regulation: If a life insurance policy has too much cash value too quickly, then it becomes a MEC policy–or modified endowment contract.

When a policy becomes a MEC, it becomes more like a retirement account. You can’t access the money until you are older without penalties, and when you take the money out, it will be a taxable event–all the same rules of a 401k or IRA.

It’s a straightforward rule and not something that can accidentally break. But it puts you in a position where it takes time to build cash value.

This is why you don’t liquidate cash value, but take loans against the policy instead.

If you liquidate the cash value, you have to start all over.

“Commissions are High, It’s Only Worth it for the Agent”

“Infinite Banking is a scam simply used to sell life insurance, which has high commissions, and it’s only valuable for the agent.”

This is a good argument–and true to a degree. Whole life insurance commissions are generally higher upfront than other investment products.

However, this is not without some benefit.

Important note: If you are considering starting an Infinite Banking policy, this is where the agent may have some control. If you cannot be sure the agent has the best intentions for you, they can skew a policy to give themselves more commission while hurting your long-term growth potential.

This concern here is the benefits when compared to the fees.

Are the benefits worth the fees?

Is an Infinite Banking policy worth the fees?

Is a mutual fund worth the fees?

What about real estate investing? Is that worth the fees?

Well, it depends on the benefit, not the fees.

In any of these cases, you must evaluate fees compared with the benefit offered on the other side of the investment.

One of the reasons individuals see Infinite Banking as a scam is because there are fees.

But most everything has fees.

The real question is, “Are the fees worth the benefit?”

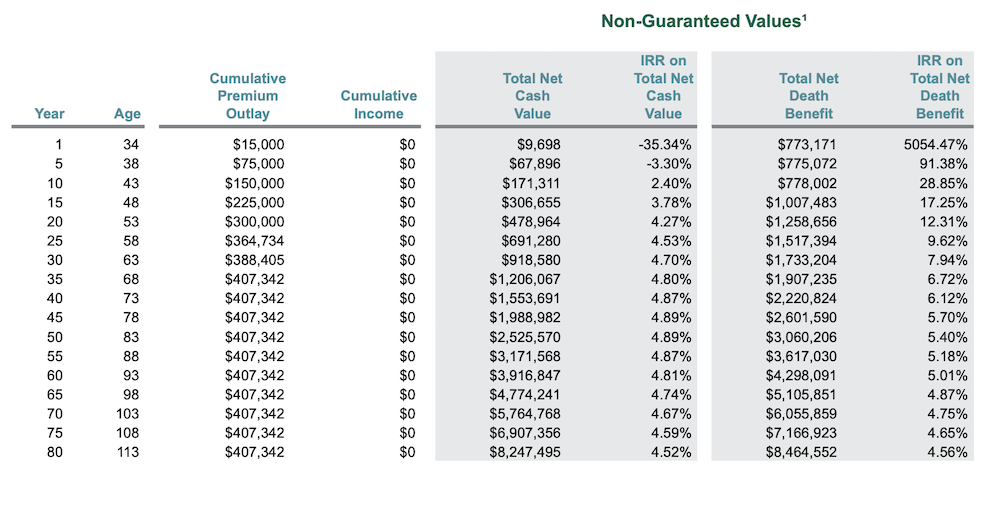

With an Infinite Banking policy, it’s laid out pretty black and white.

There is a policy illustration that you will get, which shows how much you contribute, the death benefit, the guaranteed growth, the potential growth–it’s all laid out.

On top of this, the whole life insurance policy fee is buying you a benefit–a death benefit.

It’s the only investment that gives you a significant perk, a tax-free transfer of a lump sum of cash to your beneficiary for the fee you pay.

Is the fee worth it? That’s up to you. But with a whole life policy, you can see the benefit you are getting before making a purchase and then make that decision with the information presented to us.

“Whole Life Insurance is a Bad Investment”

Another argument against Infinite Banking, calling it a scam, is that whole life insurance is a bad investment.

An Infinite Banking practitioner would probably say, “I agree!”

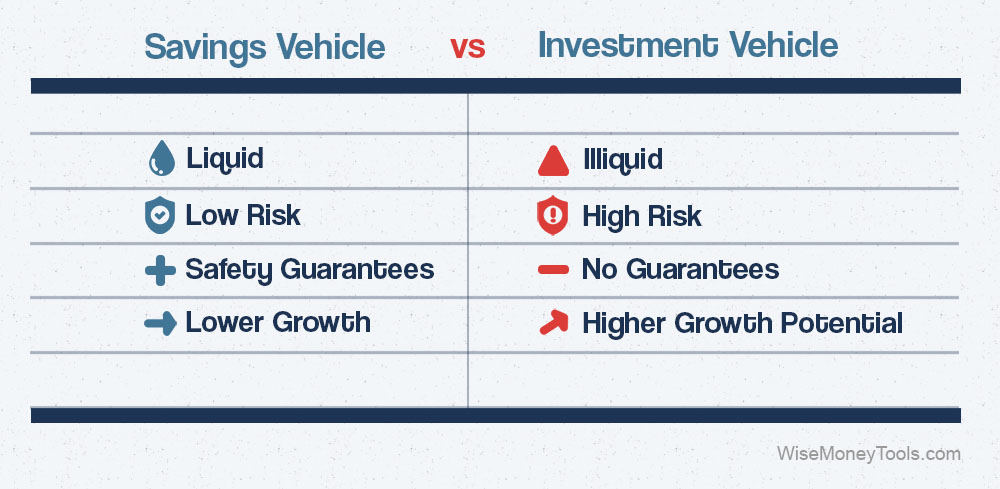

That’s because whole life isn’t an investment. And it isn’t competing with investments. It’s better classified as a savings vehicle.

There is a difference between savings and investments.

A savings vehicle is a place to store money where it can grow safely while waiting for an investment opportunity.

An investment is a higher-risk opportunity that offers a higher potential reward.

A whole life policy is where you earn a decent bottom line growth, get substantial advantages, and wait for real investment opportunities.

Where Infinite Banking shines is in providing a higher baseline return on capital. With that advantage, now you look for better investment opportunities, where previously you may have been forced to make poorer decisions.

All because you now earn more interest on your money than other savings vehicles.

Let’s compare.

Say you are earning 4% on a bond. Now, you find a medium-risk investment opportunity to earn 8% on that money.

Your bond after-tax yields 3.4%; the investment after-tax would give you 6.8%.

The spread between the bond and the investment is 3.4%.

That may be a bet worth taking in this scenario.

In contrast, let’s say you are earning 5% in your life insurance policy.

After tax, that’s–well, it’s not taxed. So that’s 5%.

Your spread between the life insurance policy and the investment is 1.8%.

Probably not worth the risk.

Because you earn a higher rate of return on your money, and that return is tax-advantaged, you wait for better investment opportunities before taking risks.

You become better investors because you can be a more patient investor.

You also earn a higher interest rate which goes a long way over time.

Whole life insurance is not an investment and doesn’t compare directly to other investments. It’s a savings vehicle that can help you make better investment decisions. The point is not to replace investing but to make investment decisions from a position of strength.

“Infinite Banking is too Complicated, it Must be a Scam”

Infinite Banking is complicated, but does that make it a scam?

Well, why is it complicated?

First, the complications from Infinite Banking, or whole life insurance, are more government-mandated than company-created. The government has created all kinds of rules centered around insurance–modified endowment contract rules, 770 account regulations, tax rules, and regulations–all these regulations make whole life insurance more complex.

The life insurance companies didn’t make these rules; the government did.

All of these rules have made whole life insurance more complicated.

However, by simply getting a whole life insurance quote or a policy illustration, you can answer many questions about whole life insurance and Infinite Banking.

As far as being complicated making it a scam, there are many complicated investments in the financial world.

Way too complicated!

Just consider the Federal Reserve’s effect on the economy, interest rate spreads, 401k and IRA laws and regulations, foreign investment tax, and reporting laws–look at any area of finance, and you will come to one conclusion.

Anything involving the government becomes extremely complicated, very quickly.

That doesn’t make it a scam. I would argue that often this is done to make things look complicated on purpose. To keep you confused so you just stay away.

With Infinite Banking, just like anything else, it’s best to find someone who can cut through the noise and help you get to the center of what it does and whether or not it will help you in your situation.

It either does or it doesn’t. It’s that simple.

“Infinite Banking Just ‘Feels’ Wrong”

Lastly, many say Infinite Banking just “feels” wrong. Something about it just makes you feel like you are getting duped.

This is an understandable feeling.

Not only is Infinite Banking a bit complicated, but it is also against the grain of Wall Street.

It’s that feeling of uncertainty, or “the unknown.”

Wall Street has done a great job setting you up to feel this way about many things.

That’s because Wall Street operates on FOMO, or the fear of missing out.

The fear that if you don’t invest the way Wall Street has taught you to invest, then you will miss out on a bigger gain–that magical gain just around the corner.

All while they collect their fees.

If Infinite Banking feels confusing at first, it’s understandable. That doesn’t mean it’s right for you, that doesn’t mean it’s wrong for you, it probably just means you don’t understand it enough to make a good decision.

And that’s good. It’s a good feeling to listen to. It’s in your best interest to understand something before making any decision.

Don’t let that feeling be a deterrent from learning. And don’t let it be a reason to make any decision. Logic can only come after education. So enjoy the part where you get to learn something new.

Then make a decision.

“Is Infinite Banking a Scam?”

After all this, you have some more information about Infinite Banking. It’s an interesting concept involving whole life insurance with some benefits and some negatives.

It’s not for everyone, but it is generally misunderstood by many of those talking about it in the media.

The best recommendation for anyone studying a financial product or concept is to learn. Take the time to understand what you are dealing with, how it can affect your life, and whether or not it fits into the financial future you are creating.

If you are taking charge of your financial future and your financial education, then you are on the right path.

I wish you the best in your journey to financial freedom and success.