Choosing the best life insurance company for Infinite Banking is no easy task. With so many insurance companies, finding the right one for you can seem near impossible.

However, with a few simple guidelines and some must-have criteria, you can narrow down potential whole life insurance companies to find the perfect one.

In this guide, we explore the characteristics needed for infinite banking. We then will look at what differentiates life insurance companies. Lastly, we will look at decisions that make the biggest impact when choosing the best life insurance company for Infinite Banking.

Criteria for Infinite Banking

Let’s start with the necessary criteria for creating an Infinite Banking Concept policy.

Infinite Banking is a concept that primarily revolves around dividend paying, whole life insurance. Using this life insurance policy, you create your own “personal bank.”

Your personal bank is for storing capital while looking for investment opportunities.

When the right investment opportunities are available, you access money from your Infinite Banking policy and invest it.

There aren’t always good investment opportunities available. While you wait, you want the highest possible growth potential without sacrificing safety and accessibility.

These are the basic premises of Infinite Banking: high growth potential, safety, and accessibility.

However, there are some key differences between life insurance companies that matter. These characteristics help to narrow down the potential companies from a vast collection, to a smaller few possible choices for Infinite Banking.

Let’s start by looking at the different types of life insurance policies for Infinite Banking.

Whole Life vs. Universal Life Insurance

To start, there are two types of life insurance for Infinite Banking: Whole life and indexed universal life (IUL).

We use both insurance products at Wise Money Tools, depending on the individual and their situation.

Most individuals start with whole life insurance and then add universal life insurance later if it fits their financial goals.

Nelson Nash, the creator of the Infinite Banking Concept, strictly used dividend paying, whole life insurance because he prioritized safety. He was motivated by removing his money from the banking system, a point of view he held as a follower of Austrian economics.

But his financial goals were likely different than yours.

There are pros and cons to using universal life vs. whole life. However, the best insurance company for a whole life policy is not necessarily the best for a universal life policy.

So, for this article, let’s narrow our focus to whole life insurance companies for Infinite Banking.

Mutual vs. Stock Whole Life Companies

Next, let’s look at dividends paid by whole life insurance companies.

Growth in a life insurance policy comes from dividends.

But each life insurance company pays dividends differently. There are two types of life insurance companies–mutual companies and stock companies.

When a stock company earns a profit, they pay that profit, in the form of dividends or stock buybacks, to the owners of the company–the stockholders.

However, a mutual company is different from a stock company. In a mutual company, policyholders themselves are the owners and share in the profits of the company.

When a mutual company earns a profit, they pay that profit, in the form of a dividend, to the owners of the company–the policyholders.

This is why, in a mutual life insurance company, your whole life insurance policy growth is greater than in a stock-based company. You receive dividends as an owner of the company.

Stock companies work to enrich their shareholders; mutual companies work to enrich their policyholders.

Each company works on behalf of its owners. However, the ownership structure is different.

Therefore, creating an Infinite Banking policy with a mutual life insurance is the better option. It provides the most growth potential and further narrows the list of potential companies.

Direct Vs. Non-Direct Recognition Companies

Our next Infinite Banking company criteria is the effect of policy loans on dividend payments.

Access, or liquidity, is at the core of how Infinite Banking works. Whether for investment or personal use, you need access to the money in your whole life policy.

To do so, you take a policy loan from the life insurance company against your cash value.

Policy loans are the best way to access the money from your policy.

But policy loans have the potential to affect the way your money is growing inside of the policy. Some insurance companies pay dividends differently when accounting for loans.

How Loans Are Recognized

The annual dividend that generates growth in your policy, is based on the cash value in your account.

There are two ways life insurance companies recognize the amount of cash value in your account if you have an outstanding loan.

A direct recognition company recognizes any loans against the policy and reduces the dividend based on the net cash value.

For instance, if you have $100,000 in cash value but have a $50,000 loan outstanding against it, the dividend is paid on the remaining $50,000 of cash value.

A non-direct recognition company does not recognize any outstanding loans against the policy and pays the dividend based on the total cash value.

Therefore, your $50,000 loan outstanding against the $100,000 cash value is not adjusted. The dividend will be paid on the full $100,000 of cash value.

It’s Not That Simple

Though the better options seem obvious on the surface, there are many factors to consider when deciding between a direct and non-direct recognition company.

For instance, if a company pays a significantly higher overall dividend, they may be a better option even if they are a direct recognition company.

Here are some of the factors to consider with each potential life insurance company for Infinite Banking:

- Dividend History

- Current Dividend

- Company Rating

- Overall Strength

- Total History

Direct and non-direct recognition is not as clear cut as choosing between a mutual vs. stock. Consider the benefits and the loan terms as well as the specifics of recognition.

However, there is a way to bypass life insurance loans that avoids any recognition conflict, regardless of the company you choose.

Cash Value Line of Credit

The best way to acquire liquid capital against a life insurance policy is through a cash value line of credit or CVLC.

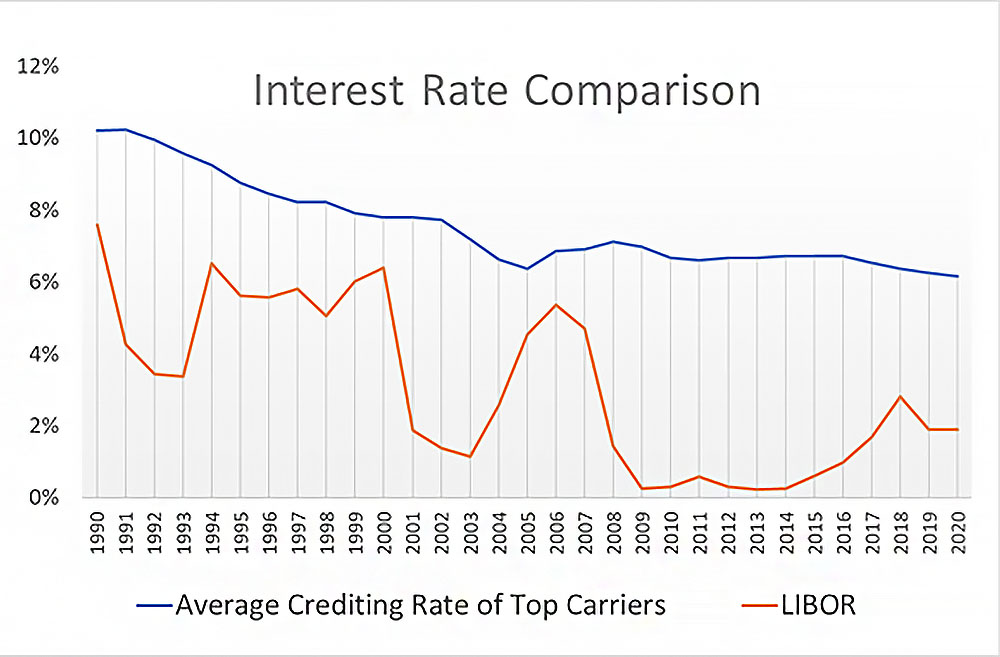

A cash value line of credit is the process of getting a bank loan against your cash value. Your cash value backs this loan, so there is no approval process. The typical loan rate historically is prime minus 1 point, which is always subject to bank changes.

Historically, a favorable spread exists between the dividend earnings in a whole-life policy and the loan cost. This spread is the basis of our leveraged life insurance strategy for higher growth rates from Infinite Banking policies.

Through this CVLC, you access the cash value in your life insurance policy without having any recognition effects on your dividend payout. Direct or non-direct recognition is unimportant and you can focus on the other characteristics that make a good life insurance company for Infinite Banking.

Now that we have narrowed our list of potential companies further, let’s look at the criteria for analyzing different life insurance companies to determine the best options.

Criteria for Life Insurance Companies

Choosing the best life insurance company for Infinite Banking is essential. You’re buying and overfunding a life insurance policy that lasts your entire life. This is why getting the best option from your life insurance company is crucial.

Let’s look at some characteristics that matter when choosing between whole life insurance companies.

Highly-Rated

The first thing you want is a highly-rated company. You want a company with high marks from all of the best rating agencies.

The typical agencies that rate insurance companies are:

You can find their ratings from these nationally recognized agencies on their websites. The insurance company you are considering might also promote their ratings through online or printed materials.

Ratings determine the safety of the life insurance company under consideration. Because this is a long-term commitment, you want to ensure you work with the most secure and highly rated companies.

What Makes a Rating?

Each ratings company analyzes an insurance company based on their own system. However, the overall goal is the same. They seek to determine:

- Short-term risk

- Long-term risk

- Overall ability to pay claims

They do this by taking a detailed look at the insurer. They look for things like:

- Market risk

- Interest rate risk

- Regulatory risk

- Capital adequacy ratio (CAR)

- Liquidity

- Growth

- Annual earnings

- Investment yield

These factors play into the overall rating that an insurance company receives.

Since this level of due diligence is nearly impossible for a layperson to conduct independently, the best alternative is looking at the ratings from multiple rating agencies.

They review these companies periodically, and ratings are adjusted to make sure they are up-to-date and relevant.

Looking through ratings is the first step in determining the best life insurance companies for an Infinite Banking policy.

Strong History

Next, you want a company with a strong history. With whole life insurance and Infinite Banking, the goal is minimizing risk.

For this reason, you want a company with a strong history of safety.

Some of the most prominent life insurance companies, like Penn Mutual, were founded in the 1800s.

You want that kind of strength in a life insurance company. Reliable life insurance companies operated through the great depression, multiple recessions, and dozens of stock market downturns.

A healthy history is a key part of the best potential companies for Infinite Banking.

Dividends Are Not Guaranteed

Part of analyzing a company’s history is looking at past dividends.

The paid dividend and the guaranteed growth rate are different. The guaranteed rate is the expected earnings regardless of circumstance.

The company pays a dividend only if they have earnings. They are not guaranteed.

The ideal life insurance companies maintain a solid history of paying dividends and earnings above the base guaranteed growth.

Many of the best companies have paid this dividend for over 100 years.

You want a company that does more than survive the bad times in history, you want a company that thrives.

A strong history shows you that the company avoids risky, short-term tactics. They focus on wealth protection and reasonable growth above all else.

And the historical record proves it.

Thus the history of the company matters a great deal. You want a company that lasts longer than you or your policy.

High-Performance

Historical performance tells you about the past, but what about the present?

For Infinite Banking, you want minimized risk, but you also want maximized returns.

Looking at the recent dividend history of the company is important, especially in comparison to peer companies.

More recent information from the company gives you a better sense of their current performance and growth potential. You want a company that will likely pay you strong dividends in the future.

The best way to judge that is looking at the most recent history.

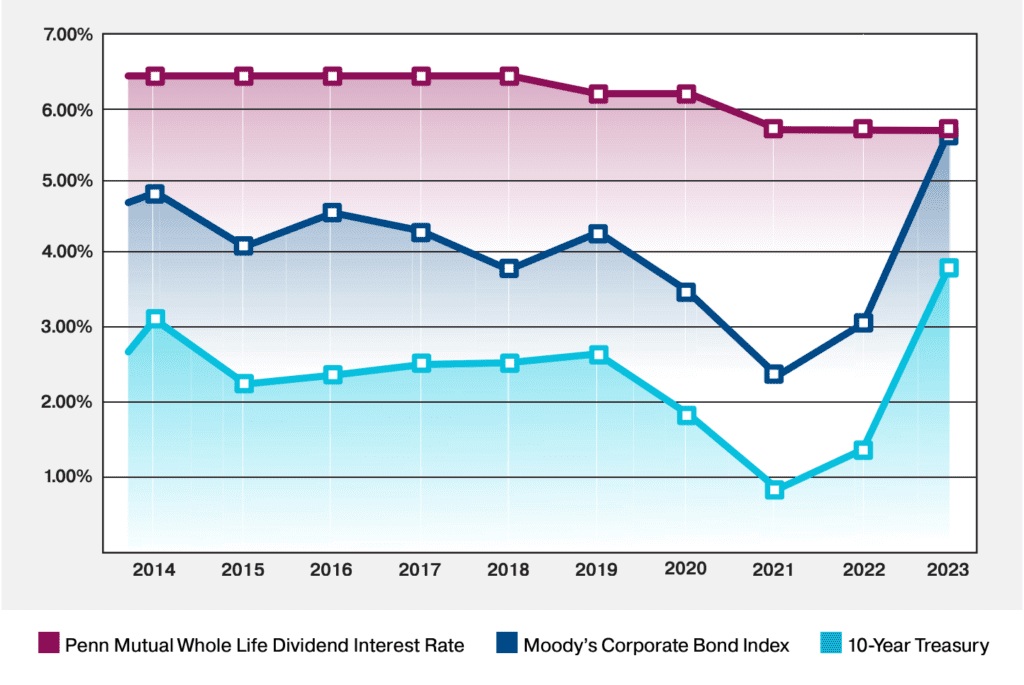

This Penn Mutual chart shows their recent dividend performance against Moody’s bond index and the 10-year treasury.

The chart demonstrates Penn Mutual has paid out a competitive dividend over the last decade.

The dividend history strongly signals that a life insurance company will continually pay worthwhile dividends in the future.

Performance matters to the bottom line. Finding a life insurance company that offers a solid recent performance is important.

To summarize, you want to find a highly-rated company with a long history that pays a competitive dividend annually. By factoring all these criteria into your choice, you put yourself in an excellent position to succeed with Infinite Banking.

However, there is still one very important variable to consider when looking for the best life insurance company for Infinite Banking–your agent.

The Difference Between Agents

There is no doubt the agent you choose makes the most difference when creating an Infinite Banking policy.

An expert who understands the different life insurance companies has the knowledge to skillfully navigate your specific situation.

A bad or inexperienced agent can ruin a policy from any insurance company, having detrimental long-term effects.

That is why choosing the right agent is so important.

The best policy for Infinite Banking often comes down to how the policy is structured, not necessarily the company the policy is structured with.

We discussed the variability between companies, but your situation will also make a big difference in which company best suits you.

Things like:

- Overall health

- Lifestyle

- Age

- History

All of these factors play into which company is best.

There is also the policy itself to consider. A policy with the same company, but structured differently, could look significantly worse than a different policy.

Policy differences include:

- Death benefit

- Cash value

- Paid-up additions

- Term riders

- Other riders

All of these variables factor into the policy that you receive.

Lastly, each life insurance company has several products with unique characteristics related to premiums, growth, and benefits.

Products like:

- 10-Pay

- 20-Pay

- Paid-Up at 65

- Executive

- Whole Life to 121

An intelligent agent chooses products based on your situation and overall financial goals.

Selecting the right company for your Infinite Banking policy matters less than the agent who puts the policy together.

So take the time to choose the best cash-value life insurance agent for you.

Our Favorite Life Insurance Companies for Infinite Banking

At Wise Money Tools, we use a few selected life insurance companies for Infinite Banking based on the criteria we discussed.

Each company we use varies based on the individual.

A few life insurance companies prefer not to be mentioned as “Infinite Banking” companies.

For this reason, we decided to give you the parameters we use for selection instead of giving you specific company recommendations.

If you contact us, we will gladly give you the names of the companies we prefer and provide you with personal policy illustrations or quotes.

Our goal is getting you the right policy from the best insurance company. We use the same companies for our personal Infinite Banking policies that we recommend to our clients.

We want you to find financial success through Infinite Banking.